• 激进投资方埃利奥特管理公司(Elliott Management)在慧与科技(Hewlett Packard Enterprise,HPE)的15亿美元持股,对CEO安东尼奥·内里来说是个麻烦,因为埃利奥特有罢免CEO的历史。慧与科技近期因未能发现其库存定价方式中的错误而导致股价暴跌。双方公司对彼此间的谈判均保持沉默,但关于埃利奥特对慧与科技的诉求,线索其实隐藏于明处。

今年4月首次有公开报道称,激进投资集团埃利奥特管理公司已持有慧与科技价值15亿美元的股份。自那以后,两家公司对此事均保持完全沉默。

这笔投资据悉属于多头头寸,而非做空该公司的空头押注。对慧与科技及其CEO安东尼奥·内里来说,这笔投资关系重大。据路透社报道,在埃利奥特入股各公司并要求与董事会谈判后,已有14位CEO被迫离职。

内里的位置岌岌可危?

《财富》杂志曾向两家公司请求置评,但两家公司均不愿就双方之间正在发生的事情发表公开评论。慧与科技(《财富》美国500强第143位)提供了一份简短声明,称“我们重视所有股东的建设性意见”,但拒绝透露具体细节。

然而,《财富》杂志采访的消息人士指出了几个隐藏在明处的线索,揭示了埃利奥特可能对慧与科技的诉求。

定价失误

今年3月,慧与科技公布了第一季度财报,导致公司股价当天暴跌近16%,当时便出现了最明显的预警信号。内里在接受CNBC采访时承认,公司在核算库存成本时犯了错误,这损害了公司的盈利能力。

内里表示:“临近季度末,我们意识到库存成本略高于我们定价中的成本。这是我们的失误,这种事本不该发生。”

这种说法其实是轻描淡写。这次失误使慧与科技的市值蒸发了逾30亿美元。

股价表现不佳

这也让慧与科技的股价受到了关注。

在埃利奥特寻求介入该公司的消息爆出当天,摩根大通(JPMorgan)分析师萨米克·查特吉及其团队发布了一份研究报告,称埃利奥特很可能是在:“(1)解决慧与科技作为独立实体相较同行企业的股票交易折价问题;以及(2)改善慧与科技的执行力和效率,以更好地对标戴尔(Dell)和思科(Cisco)等顶尖同行。”

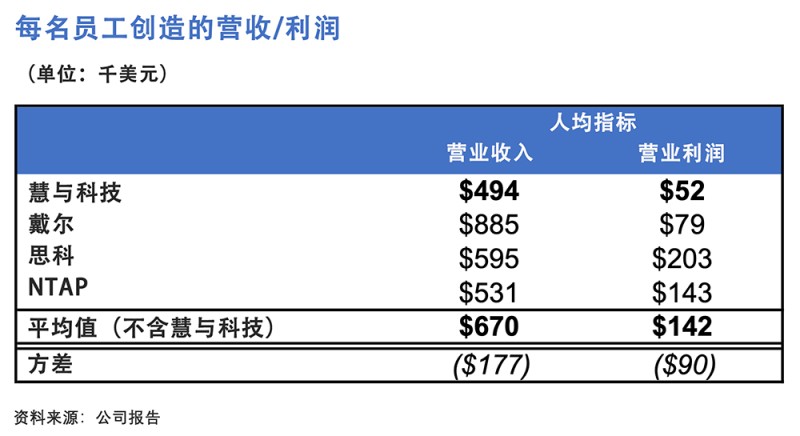

查特吉还发布了一份残酷的表格,比较了慧与科技与戴尔、思科和NetApp的业绩数据。表格显示,慧与科技每名员工仅创造49.4万美元收入,而戴尔为88.5万美元。

在美国司法部放弃对其收购瞻博网络(Juniper Networks)计划的调查后,慧与科技的股价近期有所上涨。但即便如此,自2018年以来,慧与科技的股价仅上涨了48%,至略高于每股21美元。与此同时,标普500指数上涨了135%。对于一家本应能从人工智能热潮中获益匪浅的科技公司来说,如此表现可谓惨淡。

埃利奥特倾向于避免代理权之争

内里担任CEO已有七年。与此同时,慧与科技的12名董事会成员中有6人任职已达10年或更久。董事会主席帕特丽夏·F·罗素自2015年起任职。这意味着或许是时候注入新鲜血液了。

但罢免内里可能并非埃利奥特的计划。

另一个选择是慧与科技给予埃利奥特一个董事会席位,并就公司实现逆转的战略达成一致。在埃利奥特的另一次行动中,其对炼油公司Phillips 66发起攻势,该投资基金曾向股东发出呼吁,表明它实际上更倾向于与公司达成相互协议,而不是通过股东代理投票升级为全面内战。

埃利奥特当时表示:“过去15年里,我们与200多家公司合作,达成了互利共赢、提升股东价值的解决方案。在此期间,我们仅在其他三次情况下不得不推进到美国代理权之争这一步,因此Phillips 66是一个极端的特例。”

虽然目前尚不清楚慧与科技与埃利奥特之间究竟发生了什么,但慧与科技董事会很可能正在与这个新股东进行谈判。

慧与科技对《财富》杂志表示,它对此举表示欢迎:“慧与科技及董事会就一系列问题与股东保持持续对话。虽然我们不对可能与任何股东进行的特定沟通发表评论,但我们重视所有股东以及其他所有利益相关者的建设性意见。”(*)

译者:刘进龙

审校:汪皓

• 激进投资方埃利奥特管理公司(Elliott Management)在慧与科技(Hewlett Packard Enterprise,HPE)的15亿美元持股,对CEO安东尼奥·内里来说是个麻烦,因为埃利奥特有罢免CEO的历史。慧与科技近期因未能发现其库存定价方式中的错误而导致股价暴跌。双方公司对彼此间的谈判均保持沉默,但关于埃利奥特对慧与科技的诉求,线索其实隐藏于明处。

今年4月首次有公开报道称,激进投资集团埃利奥特管理公司已持有慧与科技价值15亿美元的股份。自那以后,两家公司对此事均保持完全沉默。

这笔投资据悉属于多头头寸,而非做空该公司的空头押注。对慧与科技及其CEO安东尼奥·内里来说,这笔投资关系重大。据路透社报道,在埃利奥特入股各公司并要求与董事会谈判后,已有14位CEO被迫离职。

内里的位置岌岌可危?

《财富》杂志曾向两家公司请求置评,但两家公司均不愿就双方之间正在发生的事情发表公开评论。慧与科技(《财富》美国500强第143位)提供了一份简短声明,称“我们重视所有股东的建设性意见”,但拒绝透露具体细节。

然而,《财富》杂志采访的消息人士指出了几个隐藏在明处的线索,揭示了埃利奥特可能对慧与科技的诉求。

定价失误

今年3月,慧与科技公布了第一季度财报,导致公司股价当天暴跌近16%,当时便出现了最明显的预警信号。内里在接受CNBC采访时承认,公司在核算库存成本时犯了错误,这损害了公司的盈利能力。

内里表示:“临近季度末,我们意识到库存成本略高于我们定价中的成本。这是我们的失误,这种事本不该发生。”

这种说法其实是轻描淡写。这次失误使慧与科技的市值蒸发了逾30亿美元。

股价表现不佳

这也让慧与科技的股价受到了关注。

在埃利奥特寻求介入该公司的消息爆出当天,摩根大通(JPMorgan)分析师萨米克·查特吉及其团队发布了一份研究报告,称埃利奥特很可能是在:“(1)解决慧与科技作为独立实体相较同行企业的股票交易折价问题;以及(2)改善慧与科技的执行力和效率,以更好地对标戴尔(Dell)和思科(Cisco)等顶尖同行。”

查特吉还发布了一份残酷的表格,比较了慧与科技与戴尔、思科和NetApp的业绩数据。表格显示,慧与科技每名员工仅创造49.4万美元收入,而戴尔为88.5万美元。

在美国司法部放弃对其收购瞻博网络(Juniper Networks)计划的调查后,慧与科技的股价近期有所上涨。但即便如此,自2018年以来,慧与科技的股价仅上涨了48%,至略高于每股21美元。与此同时,标普500指数上涨了135%。对于一家本应能从人工智能热潮中获益匪浅的科技公司来说,如此表现可谓惨淡。

埃利奥特倾向于避免代理权之争

内里担任CEO已有七年。与此同时,慧与科技的12名董事会成员中有6人任职已达10年或更久。董事会主席帕特丽夏·F·罗素自2015年起任职。这意味着或许是时候注入新鲜血液了。

但罢免内里可能并非埃利奥特的计划。

另一个选择是慧与科技给予埃利奥特一个董事会席位,并就公司实现逆转的战略达成一致。在埃利奥特的另一次行动中,其对炼油公司Phillips 66发起攻势,该投资基金曾向股东发出呼吁,表明它实际上更倾向于与公司达成相互协议,而不是通过股东代理投票升级为全面内战。

埃利奥特当时表示:“过去15年里,我们与200多家公司合作,达成了互利共赢、提升股东价值的解决方案。在此期间,我们仅在其他三次情况下不得不推进到美国代理权之争这一步,因此Phillips 66是一个极端的特例。”

虽然目前尚不清楚慧与科技与埃利奥特之间究竟发生了什么,但慧与科技董事会很可能正在与这个新股东进行谈判。

慧与科技对《财富》杂志表示,它对此举表示欢迎:“慧与科技及董事会就一系列问题与股东保持持续对话。虽然我们不对可能与任何股东进行的特定沟通发表评论,但我们重视所有股东以及其他所有利益相关者的建设性意见。”(*)

译者:刘进龙

审校:汪皓

• Activist investor Elliott Management’s $1.5 billion stake in Hewlett Packard Enterprise (HPE) is a problem for CEO Antonio Neri, due to Elliott’s history of ousting CEOs. HPE recently tanked its own stock by failing to spot an error in the way it priced its inventory. Both companies have been silent on negotiations between them but clues as to what Elliott wants from HPE are hiding in plain sight.

It was first publicly reported in April that the activist investor group Elliott Management had taken a $1.5 billion stake in Hewlett Packard Enterprise (HPE), and since then there has been nothing but complete silence on the issue from both companies.

The investment—known to be a long position as opposed to a short bet against the company—is an acute one for HPE and its CEO, Antonio Neri. Fourteen chief executives have been forced out of their jobs after Elliott took a stake in their companies and demanded talks with their boards, according to Reuters.

Is Neri’s neck on the chopping block?

Fortune asked both companies for comment, but neither wanted to talk on the record about what is going on between them. HPE (No. 143 on the Fortune 500) provided a brief statement that said “we value the constructive input of all of our shareholders” but declined to go into specifics.

However, sources who talked to Fortune pointed to several clues, hiding in plain sight, about what Elliott potentially wants from HPE.

Pricing screwup

The most obvious sign of trouble occurred when HPE published its Q1 earnings in March, which tanked its stock by nearly 16% on the day. Neri gave an interview on CNBC in which he admitted that the company had made a mistake in accounting for the cost of its inventory, which hurt the profitability of the company.

“Near the end of the quarter, we realized that the cost of our inventory was slightly higher than the cost that we had in the pricing. That’s on us. That should never happen,” Neri said.

That was an understatement. The screwup wiped more than $3 billion off HPE’s market cap.

Underperforming stock

It also drew attention to HPE’s share price.

On the day the news broke that Elliott wanted influence over the company, JPMorgan analyst Samik Chatterjee and his team published a research note that said Elliott was probably “1) addressing the discount at which the shares of HPE trade on a standalone basis relative to peers; and 2) improving execution and efficiencies to better align with best-in-class peers, like Dell and Cisco.”

Chatterjee also published a brutal table comparing the performance numbers of HPE against Dell, Cisco and NetApp. It showed that HPE generated only $494,000 per employee in revenue while Dell generated $885,000:

HPE stock popped upward recently after the Department of Justice dropped an investigation into its proposed acquisition of Juniper Networks. But still, since 2018, HPE stock has risen 48% to just above $21 per share. The S&P 500, meanwhile, rose 135%. That’s a dismal performance for a tech company that ought to be benefiting mightily from the mania around AI.

Elliott prefers to avoid proxy battles

Neri has been CEO for seven years. Meanwhile, six of HPE’s 12 board members have been there for 10 years or more. The chairman of the board, Patricia F. Russo, has been there since 2015. The implication is that it might be time for new blood.

But ousting Neri may not be Elliott’s plan.

Another option would be for HPE to give Elliott a seat on the board and to agree on a strategy to turn the company around. In one of Elliott’s other adventures, its assault on the oil refinery company Phillips 66, the investment fund made a plea to shareholders that showed that it actually prefers to reach a mutal agreement with a company rather than escalate to all-out civil war via a shareholder proxy vote.

“Over the last 15 years, we have collaborated with more than 200 companies to reach mutually beneficial solutions that enhance shareholder value. During this period, we have only had to pursue a U.S. proxy contest to this stage of the process three other times, making Phillips 66 an extreme outlier,” Elliott said at the time.

While it is not clear what, exactly, is going on between HPE and Elliott, it is likely that the board is in talks with its new stakeholder.

HPE told Fortune it welcomed the move: “HPE and our Board maintain an ongoing dialogue with our shareholders on a range of issues. While we do not comment on specific communications that we may have with any our shareholders, we value the constructive input of all of our shareholders and all of our other stakeholders.”