华纳兄弟探索公司(Warner Bros. Discovery)本周二宣布,已启动对“战略替代方案”的全面评估。这套华尔街说法的潜台词就是,公司正考虑启动出售流程。过去几个月,市场一直盛传这家好莱坞老牌制片厂可能被收购。

公司在新闻稿中披露,已收到“多方主动提出的收购意向”,涉及“整个公司”及其旗下标志性华纳兄弟业务板块。据报道,本身刚被大卫·埃里森(特朗普盟友拉里·埃里森之子)收购的派拉蒙环球(Paramount Global),本月早些时候曾开出每股20美元的报价。与此同时,主导流媒体市场、并逐步成为好莱坞新势力的奈飞(Netflix)也被传为潜在买家。不过,其联席CEO格雷格·彼得斯在本月早些时候对此传闻予以淡化,并且该公司在并购领域也并非活跃角色。

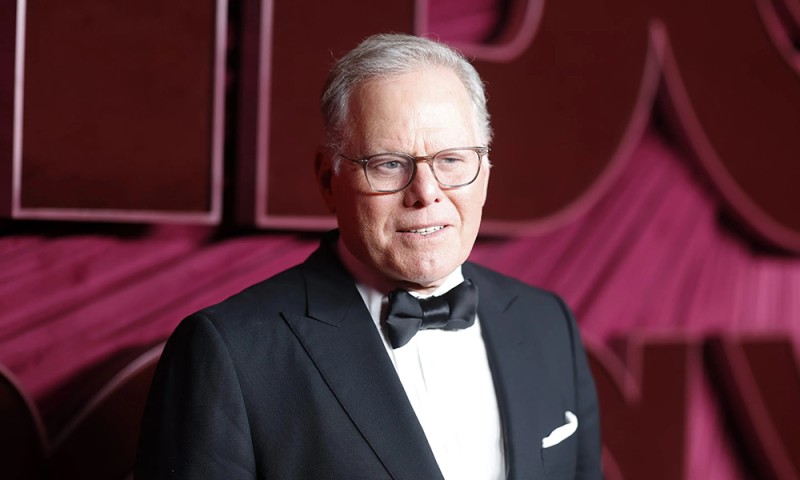

华纳兄弟探索公司CEO大卫·扎斯拉夫在新闻稿中表示:“我们的资产组合价值巨大,正受到市场上越来越多的关注,这并不令人意外。鉴于多方表达了收购意向,我们已启动对战略替代方案的全面评估,以确定能够最大限度释放公司资产价值的最佳路径。”

董事会对收购意向的回应

公司董事会确认,启动此次评估不仅是为了推进此前规划的业务拆分,也是为了考量一系列交易方案。这些方案包括:整体出售华纳兄弟探索公司、出售部分业务板块,或探索能够最大化股东价值的合并与分拆架构。

该消息发布之际,媒体行业正经历剧烈变革。内容资源库、影视制片厂以及全球发行平台的价值正在迅速攀升。华纳兄弟探索公司此前已着手筹备业务拆分,以期强化在流媒体、电影与电视领域的竞争优势。该进程原定于2026年年中完成,如今却因外部强烈的收购意向,可能出现加速或转向。无论是整体收购还是部分并购,若交易达成,都将成为好莱坞历史上最重大的行业洗牌之一。毕竟,华纳兄弟旗下的资产组合横跨HBO、DC影业(DC Studios)、CNN、探索频道(Discovery Channel) 等多个标志性品牌。

市场反应与影响

投资者反应迅速:消息一出,华纳兄弟探索公司股价飙升逾11%,市场开始消化这笔潜在“重磅交易”的可能性。此次公告发布的时机,正值科技巨头与好莱坞资本积极布局之际。最引人注目的是,甲骨文(Oracle)董事长兼首席技术官、不久前曾登顶全球首富的拉里·埃里森,已将其家族打造为媒体业的重要力量,其子大卫·埃里森正主导着派拉蒙的转型。

大卫·埃里森早在2024年7月便提出愿景,计划将派拉蒙打造为“科技混合体”,未来有望与奈飞同台竞争。为此,他已从奈飞挖来节目内容主管辛迪·霍兰德等一线核心人才,并成功网罗热门剧集《怪奇物语》(Stranger Things)的创作主力——达菲兄弟。(*)

译者:刘进龙

审校:汪皓

华纳兄弟探索公司(Warner Bros. Discovery)本周二宣布,已启动对“战略替代方案”的全面评估。这套华尔街说法的潜台词就是,公司正考虑启动出售流程。过去几个月,市场一直盛传这家好莱坞老牌制片厂可能被收购。

公司在新闻稿中披露,已收到“多方主动提出的收购意向”,涉及“整个公司”及其旗下标志性华纳兄弟业务板块。据报道,本身刚被大卫·埃里森(特朗普盟友拉里·埃里森之子)收购的派拉蒙环球(Paramount Global),本月早些时候曾开出每股20美元的报价。与此同时,主导流媒体市场、并逐步成为好莱坞新势力的奈飞(Netflix)也被传为潜在买家。不过,其联席CEO格雷格·彼得斯在本月早些时候对此传闻予以淡化,并且该公司在并购领域也并非活跃角色。

华纳兄弟探索公司CEO大卫·扎斯拉夫在新闻稿中表示:“我们的资产组合价值巨大,正受到市场上越来越多的关注,这并不令人意外。鉴于多方表达了收购意向,我们已启动对战略替代方案的全面评估,以确定能够最大限度释放公司资产价值的最佳路径。”

董事会对收购意向的回应

公司董事会确认,启动此次评估不仅是为了推进此前规划的业务拆分,也是为了考量一系列交易方案。这些方案包括:整体出售华纳兄弟探索公司、出售部分业务板块,或探索能够最大化股东价值的合并与分拆架构。

该消息发布之际,媒体行业正经历剧烈变革。内容资源库、影视制片厂以及全球发行平台的价值正在迅速攀升。华纳兄弟探索公司此前已着手筹备业务拆分,以期强化在流媒体、电影与电视领域的竞争优势。该进程原定于2026年年中完成,如今却因外部强烈的收购意向,可能出现加速或转向。无论是整体收购还是部分并购,若交易达成,都将成为好莱坞历史上最重大的行业洗牌之一。毕竟,华纳兄弟旗下的资产组合横跨HBO、DC影业(DC Studios)、CNN、探索频道(Discovery Channel) 等多个标志性品牌。

市场反应与影响

投资者反应迅速:消息一出,华纳兄弟探索公司股价飙升逾11%,市场开始消化这笔潜在“重磅交易”的可能性。此次公告发布的时机,正值科技巨头与好莱坞资本积极布局之际。最引人注目的是,甲骨文(Oracle)董事长兼首席技术官、不久前曾登顶全球首富的拉里·埃里森,已将其家族打造为媒体业的重要力量,其子大卫·埃里森正主导着派拉蒙的转型。

大卫·埃里森早在2024年7月便提出愿景,计划将派拉蒙打造为“科技混合体”,未来有望与奈飞同台竞争。为此,他已从奈飞挖来节目内容主管辛迪·霍兰德等一线核心人才,并成功网罗热门剧集《怪奇物语》(Stranger Things)的创作主力——达菲兄弟。(*)

译者:刘进龙

审校:汪皓

Warner Bros. Discovery announced Tuesday it has initiated a comprehensive review of strategic alternatives, Wall Street–speak for considering a sale process, as rumors have swirled for months that one of Hollywood’s legacy studios could be acquired.

The company disclosed in a press release that it had received “unsolicited interest from multiple parties for the entire company” and for its iconic Warner Bros. segment. Paramount Global, itself recently acquired by David Ellison, the son of Trump ally Larry Ellison, reportedly made a $20-per-share bid earlier this month. Netflix, the dominant streamer turned Hollywood power player, has also been rumored as a potential acquirer, although co-CEO Greg Peters downplayed it earlier this month, and it is not known as an active M&A player.

“It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market,” CEO David Zaslav said in the press release. “After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.”

Board response to offers

The company’s board of directors confirmed the review is taking place not only to continue with the previously outlined separation, but to consider a range of transactions. These include an outright sale of Warner Bros. Discovery as a whole, selling off separate divisions, or exploring frameworks for mergers and spinoffs that would maximize shareholder value.

The announcement comes amid a rapidly changing media landscape, where the value of content libraries, studios, and global distribution platforms has soared. Warner Bros. Discovery had already been preparing to divide operations to better position itself in streaming, film, and television markets. This process was expected to culminate by mid-2026 but is now joined by serious external interest, which could accelerate or reshape the company’s plans. Any acquisition—whether full or partial—would represent one of the biggest shake-ups in Hollywood history, given Warner Bros.’s vast portfolio, which spans HBO, DC Studios, CNN, Discovery Channel, and more.

Market reaction and implications

Investor response was instantaneous: Warner Bros. Discovery stock surged by over 11% after the news broke, as traders began to price in the possibility of a blockbuster deal. The timing of Warner Bros. Discovery’s announcement comes as tech titans and Hollywood moguls make aggressive moves. Most notably, Larry Ellison—Oracle chairman and CTO and recently the world’s richest man—has positioned his family as media power brokers, with his son, David Ellison, leading Paramount’s transformation.

David Ellison laid out a vision in July 2024 of Paramount becoming a “tech hybrid” that would one day be capable of competing with Netflix. Ellison has hired away former top-line Netflix talent for Paramount in the form of programming chief Cindy Holland, and he’s poached the creators of the Stranger Things smash, the Duffer brothers.