• 已故亿万富翁史蒂夫·乔布斯以苹果(Apple)联合创始人兼CEO的身份闻名于世,他推出了iPhone、iPad和iMac等划时代产品。然而他在苹果公司的经历并非他财富积累的真正原因。实际上,1995年,在iMac上市之前三年,凭借汤姆·汉克斯与蒂姆·艾伦的助力,乔布斯将一次意外的职业瓶颈转化为财富契机,真正实现了亿万身家。

“飞向宇宙,浩瀚无垠!”不仅是《玩具总动员》(Toy Story)中巴斯光年的经典台词,更是乔布斯成为亿万富翁的命运转折点。

1985年,一场权力斗争迫使乔布斯离开苹果公司。次年,乔布斯以1,000万美元收购了卢卡斯影业(Lucasfilm)的图形计算部门。卖家正是刚打造完《星球大战》(Star Wars)帝国的乔治·卢卡斯。这家小公司很快更名为皮克斯(Pixar),即将永远改变好莱坞与乔布斯的财富轨迹。

公司初期经营坎坷,乔布斯因需持续垫付月度资金缺口曾多次考虑是否应该将公司出售。但到1995年,他相信皮克斯已准备就绪。在11月的同一周内,公司不仅推出了首部长片《玩具总动员》,而且启动了首次公开募股。

时任CFO劳伦斯·利维写道,这让他想起奥运会百米赛跑:漫长的训练积累浓缩于瞬间爆发。

他在自己的书《孵化皮克斯:从艺术乌托邦到创意帝国的非凡之旅》中表示:“若全世界爱上《玩具总动员》,皮克斯将开启动画娱乐新纪元。”

“如若不然,皮克斯可能只会被视作又一个折戟沉沙的追梦公司。”

让乔布斯成为亿万富翁的IPO

作为持有皮克斯80%股份的控股人,乔布斯在IPO中压下了更高的筹码。若IPO成功,他将收获投资回报;若IPO失败,这不仅可能断送与迪士尼(Disney)未来合作的可能性,而且可能会导致十年的创业心血付诸东流。

所幸结果远超预期:皮克斯的股票发行价预计为12-14美元,首日收盘暴涨175%,达到了每股39美元。这主要归功于由汤姆·汉克斯和蒂姆·艾伦配音的《玩具总动员》票房表现比预期近乎翻倍。乔布斯的持股使他的资产净值随之飙升至逾10亿美元。

1997年重返苹果后,他仍持续参与皮克斯运营。随着《海底总动员》(Finding Nemo)、《超人总动员》(The Incredibles)、《美食总动员》(Ratatouille)等全球票房均破数亿美元的作品接连问世,迪士尼于2006年以74亿美元收购皮克斯的全部股票,乔布斯所持股份价值约46亿美元。

总之,乔布斯凭借直觉投资皮克斯的经历,印证了一条亘古不变的成功箴言:成功的关键在于找到热情所在并全力以赴。

苹果CEO蒂姆·库克在2015年表示:“不管未来你们做什么,这个世界都需要你们的激情、热血、不断向上的进取心。历史很少因个人而改变,但是,不要停止思考、忘记正在发生的事情。”

主业之外的财富传奇

除了乔布斯外,企业领袖通过主业外渠道积累巨额财富者不乏其人。埃隆·马斯克亦有类似经历。

这位世界首富虽因特斯拉(Tesla)与SpaceX的领导者身份而闻名,但他并非在这两家公司积攒下第一笔财富。他以超3亿美元的价格将首家公司Zip2出售给AltaVista,后来他的互联网金融公司X.com与亿万富翁彼得·蒂尔联合创立的Confinity合并成立PayPal,又让他赚得巨额财富。

同样,亿万富翁理查德·布兰森的财富也并非来自他的维珍航空(Virgin Atlantic)和维珍银河(Virgin Galactic)等航空航天业务。这位75岁的英国连续创业者成为亿万富翁,在一定程度上得益于他的唱片连锁店维珍唱片(Virgin Records)。他在1971年创立了该公司,后发展成一家音乐唱片公司,签下了滚石乐队(Rolling Stones)、珍妮特·杰克逊等巨星。1992年,布兰森以10亿美元的价格,将维珍唱片出售给英国索恩-百代集团(Thorn EMI)。(*)

译者:刘进龙

审校:汪皓

• 已故亿万富翁史蒂夫·乔布斯以苹果(Apple)联合创始人兼CEO的身份闻名于世,他推出了iPhone、iPad和iMac等划时代产品。然而他在苹果公司的经历并非他财富积累的真正原因。实际上,1995年,在iMac上市之前三年,凭借汤姆·汉克斯与蒂姆·艾伦的助力,乔布斯将一次意外的职业瓶颈转化为财富契机,真正实现了亿万身家。

“飞向宇宙,浩瀚无垠!”不仅是《玩具总动员》(Toy Story)中巴斯光年的经典台词,更是乔布斯成为亿万富翁的命运转折点。

1985年,一场权力斗争迫使乔布斯离开苹果公司。次年,乔布斯以1,000万美元收购了卢卡斯影业(Lucasfilm)的图形计算部门。卖家正是刚打造完《星球大战》(Star Wars)帝国的乔治·卢卡斯。这家小公司很快更名为皮克斯(Pixar),即将永远改变好莱坞与乔布斯的财富轨迹。

公司初期经营坎坷,乔布斯因需持续垫付月度资金缺口曾多次考虑是否应该将公司出售。但到1995年,他相信皮克斯已准备就绪。在11月的同一周内,公司不仅推出了首部长片《玩具总动员》,而且启动了首次公开募股。

时任CFO劳伦斯·利维写道,这让他想起奥运会百米赛跑:漫长的训练积累浓缩于瞬间爆发。

他在自己的书《孵化皮克斯:从艺术乌托邦到创意帝国的非凡之旅》中表示:“若全世界爱上《玩具总动员》,皮克斯将开启动画娱乐新纪元。”

“如若不然,皮克斯可能只会被视作又一个折戟沉沙的追梦公司。”

让乔布斯成为亿万富翁的IPO

作为持有皮克斯80%股份的控股人,乔布斯在IPO中压下了更高的筹码。若IPO成功,他将收获投资回报;若IPO失败,这不仅可能断送与迪士尼(Disney)未来合作的可能性,而且可能会导致十年的创业心血付诸东流。

所幸结果远超预期:皮克斯的股票发行价预计为12-14美元,首日收盘暴涨175%,达到了每股39美元。这主要归功于由汤姆·汉克斯和蒂姆·艾伦配音的《玩具总动员》票房表现比预期近乎翻倍。乔布斯的持股使他的资产净值随之飙升至逾10亿美元。

1997年重返苹果后,他仍持续参与皮克斯运营。随着《海底总动员》(Finding Nemo)、《超人总动员》(The Incredibles)、《美食总动员》(Ratatouille)等全球票房均破数亿美元的作品接连问世,迪士尼于2006年以74亿美元收购皮克斯的全部股票,乔布斯所持股份价值约46亿美元。

总之,乔布斯凭借直觉投资皮克斯的经历,印证了一条亘古不变的成功箴言:成功的关键在于找到热情所在并全力以赴。

苹果CEO蒂姆·库克在2015年表示:“不管未来你们做什么,这个世界都需要你们的激情、热血、不断向上的进取心。历史很少因个人而改变,但是,不要停止思考、忘记正在发生的事情。”

主业之外的财富传奇

除了乔布斯外,企业领袖通过主业外渠道积累巨额财富者不乏其人。埃隆·马斯克亦有类似经历。

这位世界首富虽因特斯拉(Tesla)与SpaceX的领导者身份而闻名,但他并非在这两家公司积攒下第一笔财富。他以超3亿美元的价格将首家公司Zip2出售给AltaVista,后来他的互联网金融公司X.com与亿万富翁彼得·蒂尔联合创立的Confinity合并成立PayPal,又让他赚得巨额财富。

同样,亿万富翁理查德·布兰森的财富也并非来自他的维珍航空(Virgin Atlantic)和维珍银河(Virgin Galactic)等航空航天业务。这位75岁的英国连续创业者成为亿万富翁,在一定程度上得益于他的唱片连锁店维珍唱片(Virgin Records)。他在1971年创立了该公司,后发展成一家音乐唱片公司,签下了滚石乐队(Rolling Stones)、珍妮特·杰克逊等巨星。1992年,布兰森以10亿美元的价格,将维珍唱片出售给英国索恩-百代集团(Thorn EMI)。(*)

译者:刘进龙

审校:汪皓

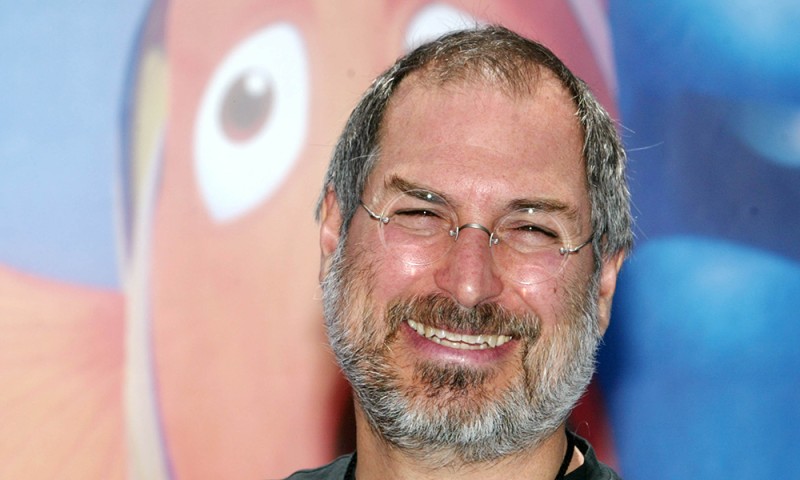

• The late billionaire Steve Jobs is known for being cofounder and CEO of Apple—and introducing the iPhone, iPad, and iMac to the world. However, his time at the computer company wasn’t what helped strike gold for his net worth. Jobs actually made the billions in 1995—three years before the iMac hit shelves—after using an unexpected career roadblock to his advantage, with a little help from Tom Hanks and Tim Allen.

“To infinity and beyond!” wasn’t just the catchphrase of Toy Story’s Buzz Lightyear—it was the turning point that turned Steve Jobs into a billionaire.

After a power struggle that forced Jobs out of Apple in 1985, Jobs bought Lucasfilm’s computer graphics division the next year for $10 million. The seller was George Lucas, fresh off creating the Star Wars empire. That small acquisition would soon be renamed Pixar—and would change both Hollywood and Jobs’ fortune forever.

The company got off to a rocky start, with Jobs questioning whether to sell it multiple times, thanks in part to having to personally cover its monthly cash shortfall. But by 1995, Jobs believed Pixar was ready for primetime. In a week’s span in November, it would release its first major film, Toy Story, as well as launch an IPO.

Lawrence Levy, the company’s then-CFO, wrote that it reminded him of the 100-meter sprint in the Olympic Games: a lifetime of training that comes down to a snapshot performance.

“If the world fell in love with Toy Story, Pixar would have a chance to usher in a new era of animated entertainment,” he said in his book, To Pixar and Beyond: My Unlikely Journey With Steve Jobs to Make Entertainment History.

“If it didn’t, Pixar might be written off as another company that tried but never quite hit the mark.”

The IPO that made Jobs a billionaire

As the 80% owner of Pixar, the IPO stakes were even higher for Jobs. If everything went well, he was hoping to finally see some return on his Pixar investment. If everything went south, it might have shut the door on any future collaboration with Disney and led to the waste of a decade of his entrepreneurial life.

Luckily, all expectations were shattered. Pixar’s initial stock price was predicted to reach between $12 and $14, but at the end of the first day of trading, it was worth 175% more, at $39 a share. This was thanks largely to Toy Story, with Tom Hanks and Tim Allen as lead voices, nearly doubling its box office expectations. Jobs’ stake sent his net worth soaring to over $1 billion.

Jobs would later rejoin Apple in 1997, but he remained involved in Pixar as it churned out hit after hit, including Finding Nemo, The Incredibles, and Ratatouille—each bringing in hundreds of millions of dollars worldwide. Disney fully acquired Pixar for about $7.4 billion in stock in 2006. Jobs’ stake was worth about $4.6 billion.

Overall, Jobs’ willingness to follow his instincts with Pixar proves the age-old advice that one key to success is finding your passion—and putting all of your energy into it.

“No matter what you do next, the world needs your energy, your passion, your impatience with progress,” Apple CEO Tim Cook said in 2015. “History rarely yields to one person, but think and never forget what happens when it does.”

Finding fortune beyond their main companies

Jobs isn’t alone in being a business leader who gained significant wealth outside of what they’re primarily known for. Elon Musk has a similar story.

While the world’s richest person is known today for being the leader of Tesla and SpaceX, that’s not how he first amassed his fortune. Musk sold his first company, Zip2, to AltaVista for more than $300 million. He also made millions through the creation of PayPal, which formed from a merger of Musk’s online financial services company, X.com, with software company Confinity, cofounded by billionaire Peter Thiel.

Similarly, billionaire Richard Branson did not make all his money from being focused on his air and space companies, Virgin Atlantic and Virgin Galactic. The 75-year-old British serial entrepreneur actually became a billionaire in part thanks to his chain of record stores called Virgin Records. It launched in 1971 and later expanded into a music label that featured artists like the Rolling Stones and Janet Jackson. Branson later sold Virgin Records in 1992 to British conglomerate Thorn EMI for $1 billion.