摩根士丹利(Morgan Stanley)最新深度分析显示,随着AI技术的普及,美国企业界将迎来一场根本性变革,每年可节省近万亿美元成本。该投行估计90%的岗位将在某种程度上受到AI自动化或增强化的影响,成本节省将直接源自人员精简、自然减员以及知识密集型常规任务的自动化处理。

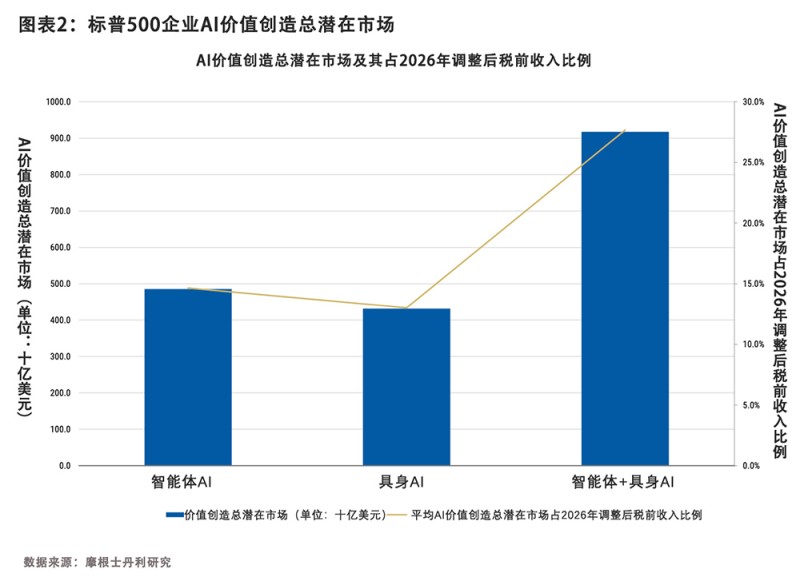

这家华尔街投行估计,大规模部署“智能体AI”软件与具身AI人形机器人技术,可为标普500指数企业创造9,200亿美元年化净效益。分析师指出,节省的绝大部分成本将来自降低薪酬支出和减少重复性或流程密集型岗位的人力需求。

预期节省金额相当于该指数2026年税前收益的28%。分析师认为,这一惊人的效率提升将在各行各业产生连锁反应。但有更多情况值得警惕,因为摩根士丹利主题投资团队警告称,成本节省“可能需要多年才能实现”,且部分企业存在“重大风险”,可能无法达到全面应用水平。他们补充道,9,200亿美元相当于标普500指数企业总薪酬支出的41%,且他们目前仅掌握了约90%标普500指数企业的充足数据。

按照分析师的说法,所谓“经济价值创造”将来自两方面:一是成本削减(通过部署AI减少各类任务的人力投入及执行成本),二是新增收入和利润,因为员工被解放出来之后,可专注于更高附加值的活动,从而创造新的收入并提升利润率。他们发现,不同行业和职业在这两方面的影响比重存在显著差异。根据估值乘数测算,9,200亿美元年经济效益可能会为标普500指数带来约13-16万亿美元的市值增长,相当于当前总市值的近四分之一。

受影响最大的行业

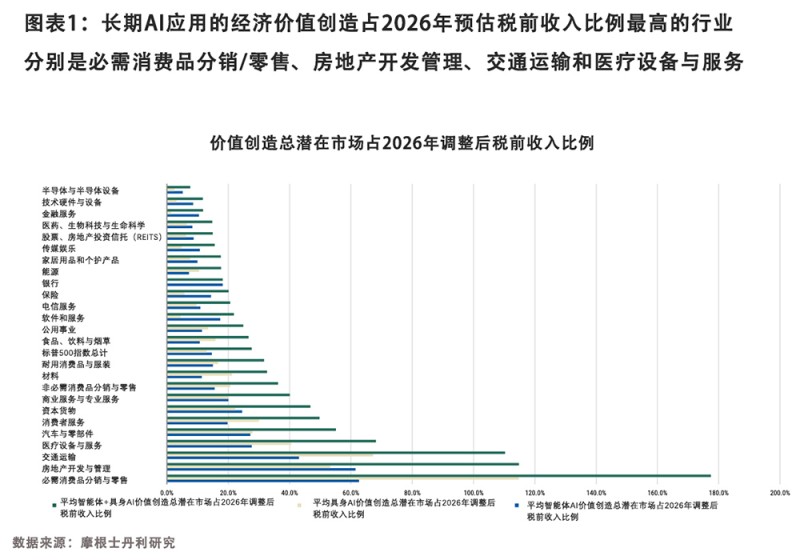

各行各业受影响程度不尽相同。如下表所示,必需消费品分销与零售、房地产管理、交通运输等行业受冲击最大,其AI驱动的生产效率收益可能超过2026年预期收益的100%。医疗设备与服务、汽车及专业服务领域也将面临重大变革与机遇。

相比之下,半导体和硬件等原本人均产值较高的行业,其AI价值创造潜力相对较低。

岗位危机与新兴职业

尽管成本节省将主要来自人力削减,摩根士丹利强调全面自动化与任务级增强存在本质区别。涵盖生成式AI和软件应用的智能体AI更倾向于任务重新分配而非直接取代人类工作岗位,而人形机器人形式的具身AI则在物流实体零售等领域更有可能直接取代人类工作岗位。

报告同时预测,在AI取代人类工作岗位的趋势中,将涌现出从首席AI官到AI治理专家等全新职业类别,这与早期技术革命催生程序员、IT专业人士和数字营销人员需求的历史规律相呼应。

漫长的渐进过程

尽管数字惊人,但分析师警告称,全面应用AI可能需要数年甚至数十年时间。企业将优先依靠自然减员和流程效率优化,而非立即大规模裁员,尤其在面向客户的营收驱动型领域。

但对投资者而言讯号明确:AI已不再是概念主题。其成本节省潜力如此巨大,有望成为2025年后推动美国企业盈利增长的最强引擎之一。(*)

译者:刘进龙

审校:汪皓

摩根士丹利(Morgan Stanley)最新深度分析显示,随着AI技术的普及,美国企业界将迎来一场根本性变革,每年可节省近万亿美元成本。该投行估计90%的岗位将在某种程度上受到AI自动化或增强化的影响,成本节省将直接源自人员精简、自然减员以及知识密集型常规任务的自动化处理。

这家华尔街投行估计,大规模部署“智能体AI”软件与具身AI人形机器人技术,可为标普500指数企业创造9,200亿美元年化净效益。分析师指出,节省的绝大部分成本将来自降低薪酬支出和减少重复性或流程密集型岗位的人力需求。

预期节省金额相当于该指数2026年税前收益的28%。分析师认为,这一惊人的效率提升将在各行各业产生连锁反应。但有更多情况值得警惕,因为摩根士丹利主题投资团队警告称,成本节省“可能需要多年才能实现”,且部分企业存在“重大风险”,可能无法达到全面应用水平。他们补充道,9,200亿美元相当于标普500指数企业总薪酬支出的41%,且他们目前仅掌握了约90%标普500指数企业的充足数据。

按照分析师的说法,所谓“经济价值创造”将来自两方面:一是成本削减(通过部署AI减少各类任务的人力投入及执行成本),二是新增收入和利润,因为员工被解放出来之后,可专注于更高附加值的活动,从而创造新的收入并提升利润率。他们发现,不同行业和职业在这两方面的影响比重存在显著差异。根据估值乘数测算,9,200亿美元年经济效益可能会为标普500指数带来约13-16万亿美元的市值增长,相当于当前总市值的近四分之一。

受影响最大的行业

各行各业受影响程度不尽相同。如下表所示,必需消费品分销与零售、房地产管理、交通运输等行业受冲击最大,其AI驱动的生产效率收益可能超过2026年预期收益的100%。医疗设备与服务、汽车及专业服务领域也将面临重大变革与机遇。

相比之下,半导体和硬件等原本人均产值较高的行业,其AI价值创造潜力相对较低。

岗位危机与新兴职业

尽管成本节省将主要来自人力削减,摩根士丹利强调全面自动化与任务级增强存在本质区别。涵盖生成式AI和软件应用的智能体AI更倾向于任务重新分配而非直接取代人类工作岗位,而人形机器人形式的具身AI则在物流实体零售等领域更有可能直接取代人类工作岗位。

报告同时预测,在AI取代人类工作岗位的趋势中,将涌现出从首席AI官到AI治理专家等全新职业类别,这与早期技术革命催生程序员、IT专业人士和数字营销人员需求的历史规律相呼应。

漫长的渐进过程

尽管数字惊人,但分析师警告称,全面应用AI可能需要数年甚至数十年时间。企业将优先依靠自然减员和流程效率优化,而非立即大规模裁员,尤其在面向客户的营收驱动型领域。

但对投资者而言讯号明确:AI已不再是概念主题。其成本节省潜力如此巨大,有望成为2025年后推动美国企业盈利增长的最强引擎之一。(*)

译者:刘进龙

审校:汪皓

Corporate America is on the brink of a radical transformation as artificial intelligence adoption could unlock nearly $1 trillion a year in savings, according to a sweeping new analysis by Morgan Stanley. The bank calculates 90% of jobs will be touched in some way by AI automation or augmentation, with cost savings flowing directly from reduced headcount, natural attrition, and automation of knowledge-intensive but routine tasks.

The Wall Street bank estimates widescale deployment of so-called agentic AI software and embodied AI humanoid robotics could generate $920 billion in net annual benefits for companies in the S&P 500. The lion’s share of those savings, analysts say, will come from lowering payroll expenses and reducing the need for human workers in repetitive or process-heavy roles.

The projected savings equate to roughly 28% of the index’s 2026 pretax earnings—a staggering efficiency gain analysts believe will reverberate across industries. There are more caveats, as Morgan Stanley’s Thematic Investing team cautions these cost savings would “likely take many years to achieve,” and they see “significant risk” of some companies not achieving full adoption levels. The $920 billion figure represents 41% of the total S&P 500 compensation expense, they add, and they only have sufficient data to run analyses for approximately 90% of the S&P 500.

The “economic value creation,” as they put it, will come in a combination of cost cutting (e.g., lower headcount and lower costs to perform a wide variety of tasks by deploying AI) and new revenue and margin generation, as employees are freed up to spend more time on higher value-added activities that could both increase revenue and enhance margins. They see a wide variety of the balance between these two impacts, based on industry and occupation. The $920 billion in annual economic benefit could translate into a $13-$16 trillion boost in market value for the S&P 500, according to the report, depending on valuation multiples. That figure would amount to nearly a quarter of today’s entire market capitalization.

Sectors most exposed

Not all industries will feel the effects equally. As you can see from the chart below, Consumer staples distribution and retail, real estate management, and transportation are among the most exposed sectors, with potential AI-driven productivity benefits exceeding 100% of forecast 2026 earnings. Healthcare equipment and services, autos, and professional services also face major disruption and opportunity.

By contrast, industries that already run lean on labor relative to earnings—such as semiconductors and hardware—show comparatively lower AI value potential.

Jobs at risk, new roles ahead

Though the topline savings will come from payroll reductions, Morgan Stanley stressed the distinction between full automation and task-level augmentation. Agentic AI, which spans generative AI and software applications, tends to reassign tasks rather than eliminate jobs outright, while embodied AI in the form of humanoid robots poses more direct substitution risks in industries such as logistics and physical retail.

The report also anticipates entirely new categories of jobs—from chief AI officers to AI governance specialists—emerging alongside the displacement trend, echoing earlier waves of technological disruption that boosted demand for programmers, IT professionals, and digital marketers.

A long ramp-up

Despite the headline number, the analysts caution full adoption is likely to unfold over years, if not decades. Firms will lean first on attrition and process efficiencies rather than immediate mass layoffs, particularly in sectors where customer-facing roles drive revenue.

Still, the message for investors is clear: AI is no longer a speculative theme. The cost savings potential is so large it could become one of the most powerful drivers of U.S. corporate earnings growth in the second half of this decade.