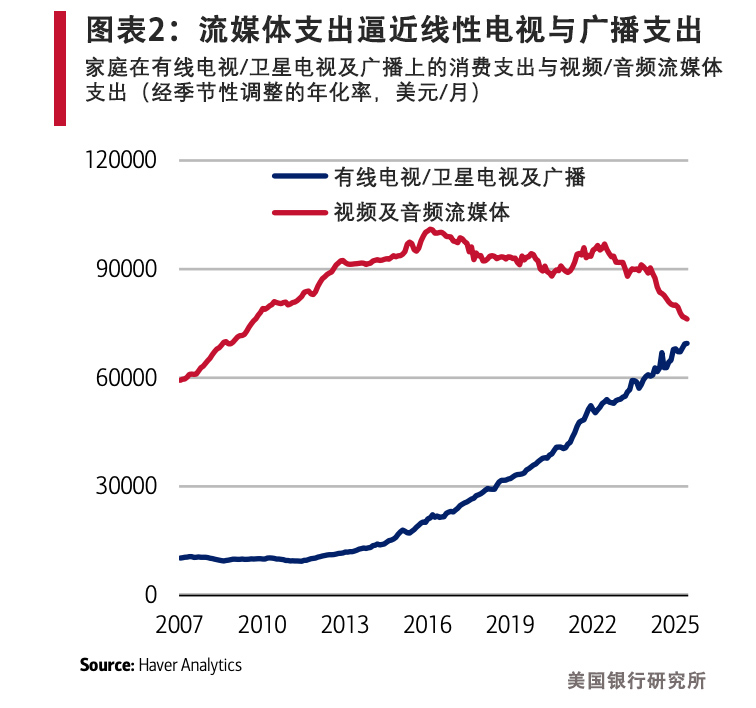

美国人观看电视的时长达到了前所未有的高度,但他们愈发倾向于通过流媒体平台而非有线电视观看节目。美国银行研究所(Bank of America Institute)数据显示,今年春季流媒体平台的收视份额正式超越传统“线性”电视,标志着人们消磨闲暇时间的方式发生历史性转变,其规模几乎与线性电视和广播的总和相当。

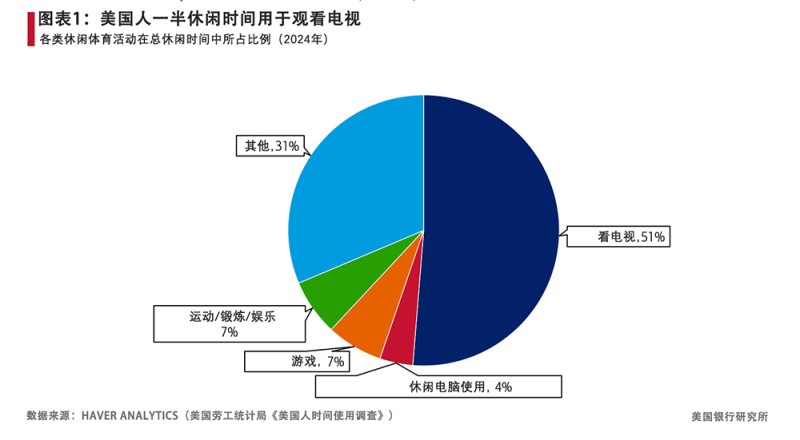

这种变化更多体现在使用平台的转变,而非需求本身的转变。美国劳工统计局的《美国时间使用调查》显示,美国人每天仍有约5小时用于休闲活动,其中超过一半的时间用于观看电视。

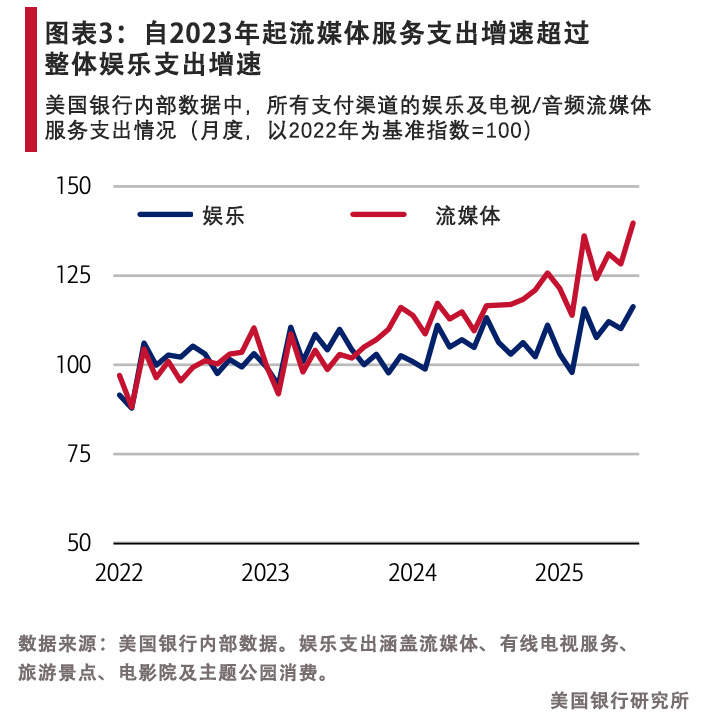

但越来越多的家庭不再频繁切换有线电视频道,转而选择每月付费订阅点播服务。美国银行(BofA)内部支付数据显示,截至7月,流媒体视频和音频支出在所有收入阶层中占比已超10%,自2023年以来,其增速已超过现场活动、影院和主题公园等其他娱乐类别。然而,美国银行高级经济学家大卫·迈克尔·廷斯利(David Michael Tinsley)领导的团队指出,尽管消费者需求不断增长,该行业仍面临新挑战:可能出现“内容衰退”。近年来,内容供应商已减少原创剧集和电影数量,转而深耕为数不多的、制作价值更高的项目。

内容衰退可能以两种形式呈现:一是订购剧集数量减少,强调“质量优于数量”的策略,以维系订户对热门IP的忠诚度;二是必看剧集数量减少,原因是流媒体平台转向低成本、大规模、更接近线性电视的制作模式。早在2023年末,亚马逊工作室(Amazon Studios)前负责人罗伊·普莱斯(Roy Price)在《纽约时报》撰文指出,随着流媒体行业发生根本性变革,精品剧时代已然终结。美国银行分析师警告称,若观众认为缺乏足量的新内容支撑持续上涨的月费,这种趋势可能阻碍行业增长。

用户流失与不平等迹象

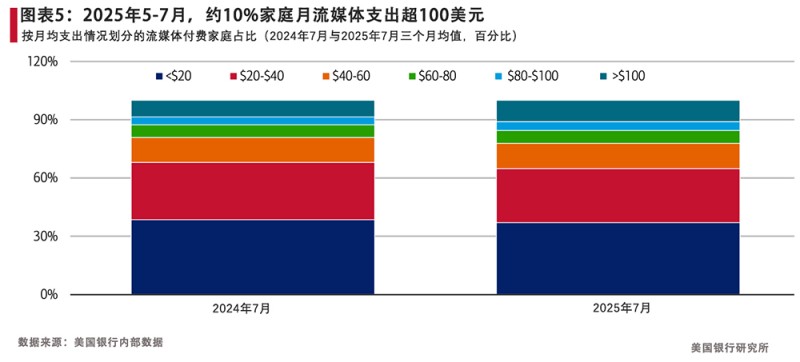

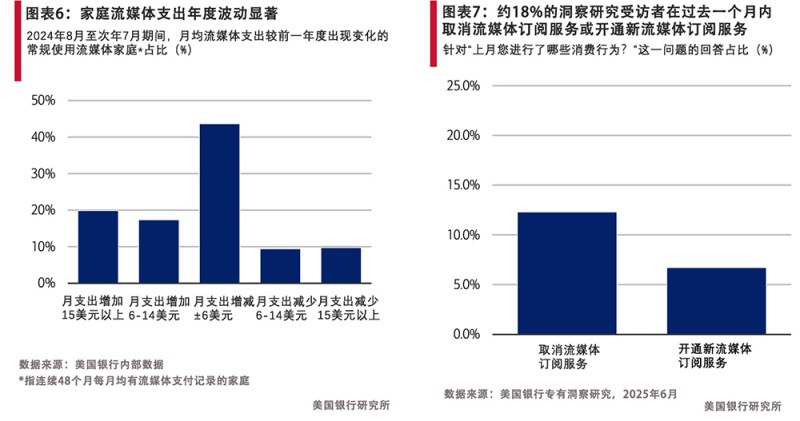

美国银行内部信用卡支出数据显示,仍有三分之二的家庭每月流媒体支出低于40美元。但费用正悄然攀升:目前约有六分之一的家庭月流媒体支出超80美元,近10%的家庭月支出超100美元。

与此同时,用户忠诚度并非板上钉钉之事。7月,近五分之一的美国人取消了流媒体订阅服务或开通了订阅服务。这种“流失”表明家庭消费策略灵活:热门新剧或体育赛事上线时选择订阅,热度消退后便弃用平台。倘若内容衰退成为现实,将加速这种动态变化,这可能决定流媒体服务在消费者心中是经济实惠的替代方案,还是与传统有线电视套餐相当的失控开支。流媒体的应对策略似乎是重新包装旧有套餐。

体育、音乐与人工智能——下一个增长前沿

当前流媒体平台正押注两大增长引擎:体育赛事直播与音乐联动。独家体育赛事转播权持续吸引订户,CivicScience调研显示,超三分之一球迷今年秋季愿为观看赛事订阅新服务。橄榄球、篮球及足球赛事的独家转播权,加之音乐与有声读物的优质内容,被视为下一个关键盈利点。女子体育赛事被视为未开发的增长领域,而音乐平台正尝试推出高价套餐,并跨界涉足现场演出领域。

人工智能是关键变量。人工智能能助力主播以更快的速度、更低的成本生成内容与特效,但也降低了新入行者的门槛。长远来看,观众甚至可能借助人工智能工具创作个性化内容,这可能颠覆流媒体公司当前押注的商业模式。

美国人短期内不会减少观看电视的时间。不过,流媒体能否持续吸引观众,更多取决于内容而非技术。若内容衰退加剧,流媒体的主导地位恐将因内容供应减少而面临考验。(*)

译者:中慧言-王芳

美国人观看电视的时长达到了前所未有的高度,但他们愈发倾向于通过流媒体平台而非有线电视观看节目。美国银行研究所(Bank of America Institute)数据显示,今年春季流媒体平台的收视份额正式超越传统“线性”电视,标志着人们消磨闲暇时间的方式发生历史性转变,其规模几乎与线性电视和广播的总和相当。

这种变化更多体现在使用平台的转变,而非需求本身的转变。美国劳工统计局的《美国时间使用调查》显示,美国人每天仍有约5小时用于休闲活动,其中超过一半的时间用于观看电视。

但越来越多的家庭不再频繁切换有线电视频道,转而选择每月付费订阅点播服务。美国银行(BofA)内部支付数据显示,截至7月,流媒体视频和音频支出在所有收入阶层中占比已超10%,自2023年以来,其增速已超过现场活动、影院和主题公园等其他娱乐类别。然而,美国银行高级经济学家大卫·迈克尔·廷斯利(David Michael Tinsley)领导的团队指出,尽管消费者需求不断增长,该行业仍面临新挑战:可能出现“内容衰退”。近年来,内容供应商已减少原创剧集和电影数量,转而深耕为数不多的、制作价值更高的项目。

内容衰退可能以两种形式呈现:一是订购剧集数量减少,强调“质量优于数量”的策略,以维系订户对热门IP的忠诚度;二是必看剧集数量减少,原因是流媒体平台转向低成本、大规模、更接近线性电视的制作模式。早在2023年末,亚马逊工作室(Amazon Studios)前负责人罗伊·普莱斯(Roy Price)在《纽约时报》撰文指出,随着流媒体行业发生根本性变革,精品剧时代已然终结。美国银行分析师警告称,若观众认为缺乏足量的新内容支撑持续上涨的月费,这种趋势可能阻碍行业增长。

用户流失与不平等迹象

美国银行内部信用卡支出数据显示,仍有三分之二的家庭每月流媒体支出低于40美元。但费用正悄然攀升:目前约有六分之一的家庭月流媒体支出超80美元,近10%的家庭月支出超100美元。

与此同时,用户忠诚度并非板上钉钉之事。7月,近五分之一的美国人取消了流媒体订阅服务或开通了订阅服务。这种“流失”表明家庭消费策略灵活:热门新剧或体育赛事上线时选择订阅,热度消退后便弃用平台。倘若内容衰退成为现实,将加速这种动态变化,这可能决定流媒体服务在消费者心中是经济实惠的替代方案,还是与传统有线电视套餐相当的失控开支。流媒体的应对策略似乎是重新包装旧有套餐。

体育、音乐与人工智能——下一个增长前沿

当前流媒体平台正押注两大增长引擎:体育赛事直播与音乐联动。独家体育赛事转播权持续吸引订户,CivicScience调研显示,超三分之一球迷今年秋季愿为观看赛事订阅新服务。橄榄球、篮球及足球赛事的独家转播权,加之音乐与有声读物的优质内容,被视为下一个关键盈利点。女子体育赛事被视为未开发的增长领域,而音乐平台正尝试推出高价套餐,并跨界涉足现场演出领域。

人工智能是关键变量。人工智能能助力主播以更快的速度、更低的成本生成内容与特效,但也降低了新入行者的门槛。长远来看,观众甚至可能借助人工智能工具创作个性化内容,这可能颠覆流媒体公司当前押注的商业模式。

美国人短期内不会减少观看电视的时间。不过,流媒体能否持续吸引观众,更多取决于内容而非技术。若内容衰退加剧,流媒体的主导地位恐将因内容供应减少而面临考验。(*)

译者:中慧言-王芳

Americans are watching more television than ever, but the screen they turn to increasingly isn’t wired for cable. According to Bank of America Institute, streaming platforms officially overtook traditional “linear” television in viewership share this spring, marking a historic shift in how people spend their downtime. It’s almost as large as linear TV and radio combined.

The change is more about delivery than demand. The Bureau of Labor Statistics’ American Time Use Survey shows Americans still devote about five hours a day to leisure, with more than half of that time spent watching TV.

But instead of flipping through cable channels, more households are paying monthly for on-demand services. Internal BofA payments data shows streaming video and audio represented more than 10% of spending across all income cohorts as of July, and since 2023, it has outpaced other entertainment categories such as live events, theaters, and theme parks. Yet even as consumer appetite grows, the industry faces a new challenge, writes the BofA team led by senior economist David Michael Tinsley: a possible “content recession.” In recent years, providers have dialed back the sheer volume of original shows and films, shifting instead to fewer projects with higher production values.

The content recession could be seen in two ways: either a pullback in the number of shows being commissioned, an emphasis on “quality over quantity” play that may keep subscribers loyal to franchise hits, or a recession in terms of the number of must-watch shows being made as streamers embrace a cheaper, mass production, more linear-TV-like model. As long ago as late 2023, former Amazon Studios chief Roy Price wrote a New York Times opinion piece declaring the era of prestige TV was ending as streaming underwent a fundamental change. BofA analysts caution this could stall growth if viewers feel there isn’t enough fresh material to justify rising monthly bills.

Signs of churn and inequality

BofA’s internal card-spending data shows two-thirds of households are still paying less than $40 a month for streaming. But the bills are creeping up: Roughly one in six households now spends more than $80 per month, and nearly 10% are shelling out over $100.

At the same time, loyalty isn’t a given. Nearly one in five Americans canceled or started a streaming subscription in July. That “churn” means households are nimble, signing up when a hot new series or sporting event arrives, then abandoning platforms when the buzz fades. A content recession materializing could supercharge this dynamic, which could mean the difference between feeling like streaming is an affordable alternative or a runaway expense that rivals old cable bundles. Streaming’s solution to this appears to be reinventing that old bundle in a new form.

Sports, music—and AI—as the next frontier

For now, streamers are betting big on two growth drivers: live sports and music tie-ins. Exclusive sports rights continue to draw subscribers, with CivicScience finding more than a third of fans are willing to sign up for a new service this fall just to watch games. Exclusive rights to football, basketball, and soccer games, plus premium offerings in music and audiobooks, are seen as the next big moneymakers. Women’s sports are seen as an untapped growth area, while music platforms are experimenting with higher-priced tiers and crossover into live events.

The wild card is artificial intelligence. AI could allow streamers to generate content and effects faster and more cheaply, but it also lowers the barriers for new entrants. In the long run, viewers themselves may even use AI tools to create personalized content, potentially disrupting the very model streaming companies are betting on.

Americans aren’t giving up screen time anytime soon. But whether streamers can keep those screens tuned in will depend less on technology than on storytelling. If the content recession deepens, streaming’s dominance could be tested by its own shrinking pipeline.