从在德意志银行任职,到现任阿波罗全球管理公司(Apollo Global Management)首席经济学家,托尔斯滕·斯洛克多年来始终以精准图表分析在华尔街引发关注。他的市场洞见甚至曾获彭博社专题报道。今年夏天,他更是最早预言股市可能出现人工智能泡沫的权威声音之一。

如今,斯洛克发现,上世纪七八十年代的“通胀高山”与2021年的通胀浪潮之间存在着惊人的相似之处——几乎达到了令人毛骨悚然的“恐怖谷”效应,更令人不安的是,美国经济未来走势正呈现出高度相似的轨迹。在8月31日发布的《Daily Spark》简报中,斯洛克指出关税政策、美元贬值以及联邦公开市场委员会(FOMC)内部关于如何平衡通胀上升与就业放缓之间日益加剧的分歧,正在加大通胀和通胀预期的上行压力。(美国银行研究部门(Bank of America Research)在一份题为《2007年幽灵》的报告中也指出,美联储极少会在通胀上升背景下选择降息。)

斯洛克补充道:“风险正在上升,未来数月可能出现另一座‘通胀高山’。”

预警信号浮现

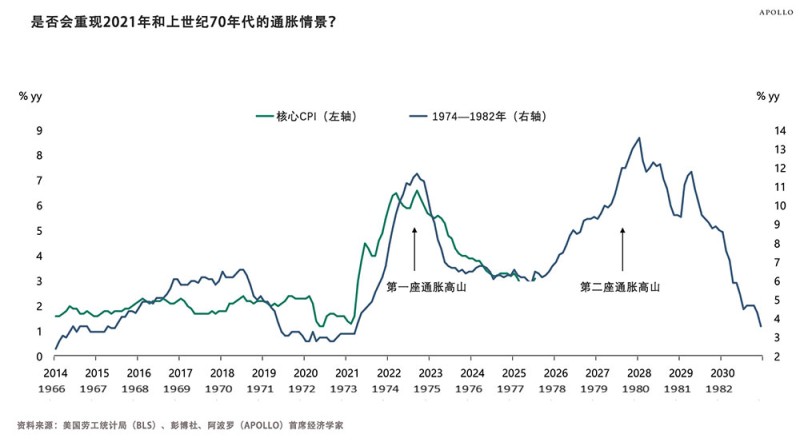

斯洛克和阿波罗发布的图表将当前美国核心CPI走势与1974—1982年通胀周期进行对比,清晰显示1973—1974年与2021—2022年两轮通胀浪潮存在高度相似性。如箭头所示,第一座“通胀高山”于1970年代出现,之后,第二座于1978年前后再度出现。如果历史重演,美国经济将在2025年秋季再次攀上通胀新高峰。

尽管斯洛克未在简报中明言,但“第一座通胀高山”指的是初始通胀峰值,而“第二座高山”则代表数年后因外部冲击与政策失误导致的更剧烈通胀攀升。

通胀担忧加剧

这并非斯洛克首次发出通胀警告。早在8月下旬,他就指出,杰罗姆·鲍威尔在杰克逊霍尔研讨会上使用“奇妙平衡状态”来形容劳动力市场,表明美联储已意识到关税与移民政策造成的结构性扭曲。斯洛克指出,如果这些因素持续推高通胀,而鲍威尔又迫于白宫压力降息,就可能重蹈上世纪70年代“走走停停"货币政策的覆辙——而这正是第二座通胀高山形成的背景。

这种似曾相识的场景令人想起上世纪70年代,如果美联储过早放松货币政策,通胀可能再度飙升,最终不得不采取鲍威尔前任保罗·沃尔克时代的痛苦纠偏措施——当年沃尔克激进加息,承受了严重的“双重衰退”。

最新通胀数据显示,7月个人消费支出(PCE)物价指数同比上涨2.6%,涨幅与6月持平,且符合经济学家预期。但剔除波动较大的食品和能源类别后,物价同比上涨2.9%,高于6月的2.8%,创下自2月以来新高。《财富》记者伊娃·罗伊特伯格指出,非必需消费品类支出已出现回落迹象。同期,广义消费者价格指数(CPI)增幅为2.7%,低于预期;而生产者价格指数(PPI)则因批发价格上涨3.3%而高于预期。

这些警告出现之际,经济学家们正就2020年代下半程的经济形态展开激烈讨论:究竟会迎来经济衰退,还是会出现伴随斯洛克所述“通胀高山”的滞胀现象?瑞银经过对美国经济硬数据研判,认为衰退风险显著上升,7月风险概率高达93%,不过结合其专有模型对其他条件的分析后,平均衰退风险要低得多。但瑞银仍预测,美国经济前景将趋于“疲软”,这与美国银行研究部门的判断不谋而合。

摩根大通则对7月意外疲软的就业报告深感忧虑,称如此幅度的劳动力需求下滑“无疑是经济衰退预警信号”。同时,穆迪分析公司首席经济学家马克·赞迪8月初曾援引与瑞银相似的硬数据警告称,美国正处在衰退边缘。最近,赞迪将美国经济衰退的概率调整为50%,并表示占美国GDP总量近三分之一的各州要么已陷入衰退,要么正面临衰退风险。斯洛克的分析则提出一个关键问题:当衰退撞上“通胀高山”时,经济将面临何种局面?(*)

译者:刘进龙

审校:汪皓

从在德意志银行任职,到现任阿波罗全球管理公司(Apollo Global Management)首席经济学家,托尔斯滕·斯洛克多年来始终以精准图表分析在华尔街引发关注。他的市场洞见甚至曾获彭博社专题报道。今年夏天,他更是最早预言股市可能出现人工智能泡沫的权威声音之一。

如今,斯洛克发现,上世纪七八十年代的“通胀高山”与2021年的通胀浪潮之间存在着惊人的相似之处——几乎达到了令人毛骨悚然的“恐怖谷”效应,更令人不安的是,美国经济未来走势正呈现出高度相似的轨迹。在8月31日发布的《Daily Spark》简报中,斯洛克指出关税政策、美元贬值以及联邦公开市场委员会(FOMC)内部关于如何平衡通胀上升与就业放缓之间日益加剧的分歧,正在加大通胀和通胀预期的上行压力。(美国银行研究部门(Bank of America Research)在一份题为《2007年幽灵》的报告中也指出,美联储极少会在通胀上升背景下选择降息。)

斯洛克补充道:“风险正在上升,未来数月可能出现另一座‘通胀高山’。”

预警信号浮现

斯洛克和阿波罗发布的图表将当前美国核心CPI走势与1974—1982年通胀周期进行对比,清晰显示1973—1974年与2021—2022年两轮通胀浪潮存在高度相似性。如箭头所示,第一座“通胀高山”于1970年代出现,之后,第二座于1978年前后再度出现。如果历史重演,美国经济将在2025年秋季再次攀上通胀新高峰。

尽管斯洛克未在简报中明言,但“第一座通胀高山”指的是初始通胀峰值,而“第二座高山”则代表数年后因外部冲击与政策失误导致的更剧烈通胀攀升。

通胀担忧加剧

这并非斯洛克首次发出通胀警告。早在8月下旬,他就指出,杰罗姆·鲍威尔在杰克逊霍尔研讨会上使用“奇妙平衡状态”来形容劳动力市场,表明美联储已意识到关税与移民政策造成的结构性扭曲。斯洛克指出,如果这些因素持续推高通胀,而鲍威尔又迫于白宫压力降息,就可能重蹈上世纪70年代“走走停停"货币政策的覆辙——而这正是第二座通胀高山形成的背景。

这种似曾相识的场景令人想起上世纪70年代,如果美联储过早放松货币政策,通胀可能再度飙升,最终不得不采取鲍威尔前任保罗·沃尔克时代的痛苦纠偏措施——当年沃尔克激进加息,承受了严重的“双重衰退”。

最新通胀数据显示,7月个人消费支出(PCE)物价指数同比上涨2.6%,涨幅与6月持平,且符合经济学家预期。但剔除波动较大的食品和能源类别后,物价同比上涨2.9%,高于6月的2.8%,创下自2月以来新高。《财富》记者伊娃·罗伊特伯格指出,非必需消费品类支出已出现回落迹象。同期,广义消费者价格指数(CPI)增幅为2.7%,低于预期;而生产者价格指数(PPI)则因批发价格上涨3.3%而高于预期。

这些警告出现之际,经济学家们正就2020年代下半程的经济形态展开激烈讨论:究竟会迎来经济衰退,还是会出现伴随斯洛克所述“通胀高山”的滞胀现象?瑞银经过对美国经济硬数据研判,认为衰退风险显著上升,7月风险概率高达93%,不过结合其专有模型对其他条件的分析后,平均衰退风险要低得多。但瑞银仍预测,美国经济前景将趋于“疲软”,这与美国银行研究部门的判断不谋而合。

摩根大通则对7月意外疲软的就业报告深感忧虑,称如此幅度的劳动力需求下滑“无疑是经济衰退预警信号”。同时,穆迪分析公司首席经济学家马克·赞迪8月初曾援引与瑞银相似的硬数据警告称,美国正处在衰退边缘。最近,赞迪将美国经济衰退的概率调整为50%,并表示占美国GDP总量近三分之一的各州要么已陷入衰退,要么正面临衰退风险。斯洛克的分析则提出一个关键问题:当衰退撞上“通胀高山”时,经济将面临何种局面?(*)

译者:刘进龙

审校:汪皓

Torsten Slok has been turning heads on Wall Street with his charts for years, since he was at Deutsche Bank and continuing on into his current role at Apollo Global Management. His market analysis earned him a profile in Bloomberg, and he was one of the first prominent voices to warn of a potential AI bubble in stocks in the summer of 2025.

Now he sees an uncanny resemblance—almost an uncanny valley—between the inflation mountain range of the 1970s and ’80s and the inflation wave of 2021, plus what may lie ahead for the U.S. economy. In his Daily Spark newsletter on Aug. 31, Slok noted the upside pressure on inflation and inflation expectations from tariffs; dollar depreciation; and growing disagreement within the Federal Open Market Committee about how to balance rising inflation with slowing employment. (In a note titled “Ghosts of 2007,” Bank of America Research observed that the Fed has rarely cut rates against a backdrop of rising inflation.)

“The risks are rising,” Slok added, “that we could see another ‘inflation mountain’ emerge over the coming months.”

Warning signs emerge

The chart shared by Slok and Apollo juxtaposes the current path of U.S. core CPI with inflation periods from 1974 to 1982, illustrating a close similarity between the inflation wave of 1973–74 with that of 2021–22. As Slok’s arrows demonstrate, the first “inflation mountain” of the 1970s was followed by another, taking off around 1978. If the pattern holds, the economy would be due to scale another peak starting almost exactly in the fall of 2025.

Although Slok doesn’t say this in his note, the “first inflation mountain” refers to the initial spike, while the “second mountain” represents the even steeper climb that followed several years later, driven by external shocks and policy missteps.

Mounting inflation fears

These aren’t the first warnings on inflation from Slok. In late August, he argued that Jerome Powell’s choice of words at the Jackson Hole Symposium—saying the labor market is in a “curious kind of balance”—showed that the Fed sees structural distortions from tariffs and immigration policy. If those forces keep inflation sticky and Powell cuts rates, as he’s under pressure from the White House to do, Slok wrote that he could be vulnerable to a 1970s-style “stop-go” policy mistake—the backdrop for the second inflation mountain.

In such a scenario, reminiscent of the ‘70s, if the Fed loosens policy prematurely, inflation could spike, leading to the painful corrective measures seen under Powell’s predecessor Paul Volcker, who hiked rates aggressively and weathered severe, double-dip recessions.

The most recent inflation read, the personal consumption expenditures index, showed prices rising 2.6% in July compared with a year ago, the same annual increase as in June and in line with what economists expected. Excluding the more volatile food and energy categories, prices rose 2.9%, up from 2.8% in June and the highest since February, with Fortune’s Eva Roytburg reporting that there was a pullback in spending in discretionary categories. The broader consumer price index was flatter than expected at 2.7%, while the producer price index was higher than expected as wholesale prices rose 3.3%, both over the same period.

These warnings come as economists debate the shape of the back half of the 2020s, questioning whether a recession is ahead or the “stagflation” that accompanied the inflation mountains of Slok’s analysis. UBS sees an elevated recession risk in the U.S. economy’s hard data, coming in at 93% in July—although its average recession risk is much lower given its proprietary analysis of other conditions. Still, it forecasts a “soggy” economy ahead, much like Bank of America Research.

JPMorgan was alarmed by July’s shockingly soft jobs report, saying that a slide in labor demand of the magnitude shown “is a recession warning signal.” Meanwhile, Mark Zandi, chief economist for Moody’s Analytics, warned in early August the U.S. was on the precipice of a recession, citing much of the same hard data as UBS. More recently, Zandi has put the odds of a recession at 50-50, and he’s said that states representing almost one-third of GDP were either in recession already or at risk of it. Slok’s analysis poses the question: What happens if and when that slams into an inflation mountain?