• 华尔街预期美联储将在下周降息25个基点,但鉴于近期劳动力市场数据疲软,一些人猜测鲍威尔可能会“大幅”降息50个基点。受市场对资金成本下降的预期推动,全球市场及美国标普500指数期货上涨。但在美联储作出决策前,仍有两轮通胀数据待公布。

投资者在消化了上周美国劳动力市场的惨淡数据后,普遍认为美联储降息25个基点已成定局。当前市场的讨论焦点在于,美联储主席杰罗姆·鲍威尔是会“大幅”降息50个基点,给市场一个“惊喜”,还是会选择逐月进行25基点的渐进式降息。

市场普遍预期美联储仅会降息25个基点。但在芝加哥商品交易所(CME)联邦基金期货市场中,仍有不足10%的投机者认为美联储可能会降息50个基点。

Convera公司的乔治·维西在一份报告中表示:“整体市场心理已发生转变。自鲍威尔在杰克逊霍尔转变立场以来,问题已不再是美联储是否会采取宽松政策,而是以多快的速度推进。”

潘西恩宏观经济咨询公司(Pantheon Macroeconomics)预测今年将降息三次,每次降息25个基点;韦德布什(Wedbush)的塞思·巴沙姆则预测会有两次降息。

投资者之所以对降息深信不疑,是因为非农就业报告整体数据已显疲软(仅新增2.2万个就业岗位),而私营部门的数据更为惨淡。阿波罗全球管理公司(Apollo Global Management)的托斯滕·斯洛克表示,在受特朗普总统贸易关税影响最严重的行业中,就业增长为负值。6月份的修正就业数据同样为负值。

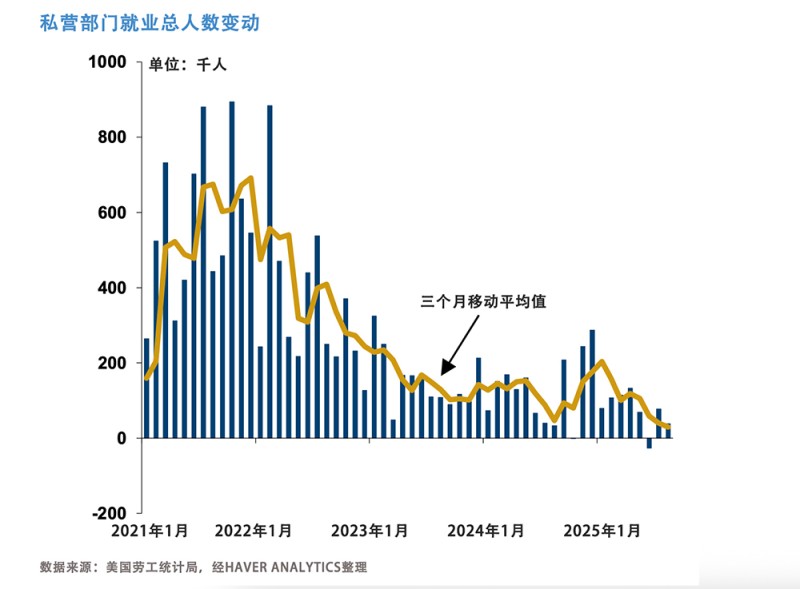

大和资本市场(Daiwa Capital Markets)的一份报告显示,6月至8月,私营部门平均每月新增就业人数仅2.9万人,较第一季度实施关税前10万人的月均增幅大幅下滑:

大和资本市场的劳伦斯·韦瑟和布伦丹·斯图尔特指出了另一个令人担忧的指标:私营部门就业扩散指数。该指数调查了258个私营行业,结果显示裁员企业数量已超过招聘企业。8月份该指数降至48,低于50即表明招聘为负增长。

美联储将面临履行“双重使命”中促进充分就业职责的压力。然而,鲍威尔面临的一个难题是,本周将公布新的生产者价格指数(PPI)和消费者价格指数(CPI)数据,市场预期这两项数据将显示通胀继续上行。美联储“双重使命”的另一个职责是抑制通胀——正因如此,部分经济学家仍认为降息25个基点并不像股市所预期的那样板上钉钉。

德意志银行(Deutsche Bank)的吉姆·里德团队在致客户的报告中表示:“尽管美联储目前已进入静默期,但周三的PPI数据,尤其是周四的CPI数据,将提前影响市场定价。目前市场已完全消化降息25个基点的预期,但对降息50个基点并无明显预期。我们的经济学家认为,除非本周通胀数据异常疲弱,否则不会出现大幅降息。”(*)

译者:刘进龙

审校:汪皓

• 华尔街预期美联储将在下周降息25个基点,但鉴于近期劳动力市场数据疲软,一些人猜测鲍威尔可能会“大幅”降息50个基点。受市场对资金成本下降的预期推动,全球市场及美国标普500指数期货上涨。但在美联储作出决策前,仍有两轮通胀数据待公布。

投资者在消化了上周美国劳动力市场的惨淡数据后,普遍认为美联储降息25个基点已成定局。当前市场的讨论焦点在于,美联储主席杰罗姆·鲍威尔是会“大幅”降息50个基点,给市场一个“惊喜”,还是会选择逐月进行25基点的渐进式降息。

市场普遍预期美联储仅会降息25个基点。但在芝加哥商品交易所(CME)联邦基金期货市场中,仍有不足10%的投机者认为美联储可能会降息50个基点。

Convera公司的乔治·维西在一份报告中表示:“整体市场心理已发生转变。自鲍威尔在杰克逊霍尔转变立场以来,问题已不再是美联储是否会采取宽松政策,而是以多快的速度推进。”

潘西恩宏观经济咨询公司(Pantheon Macroeconomics)预测今年将降息三次,每次降息25个基点;韦德布什(Wedbush)的塞思·巴沙姆则预测会有两次降息。

投资者之所以对降息深信不疑,是因为非农就业报告整体数据已显疲软(仅新增2.2万个就业岗位),而私营部门的数据更为惨淡。阿波罗全球管理公司(Apollo Global Management)的托斯滕·斯洛克表示,在受特朗普总统贸易关税影响最严重的行业中,就业增长为负值。6月份的修正就业数据同样为负值。

大和资本市场(Daiwa Capital Markets)的一份报告显示,6月至8月,私营部门平均每月新增就业人数仅2.9万人,较第一季度实施关税前10万人的月均增幅大幅下滑:

大和资本市场的劳伦斯·韦瑟和布伦丹·斯图尔特指出了另一个令人担忧的指标:私营部门就业扩散指数。该指数调查了258个私营行业,结果显示裁员企业数量已超过招聘企业。8月份该指数降至48,低于50即表明招聘为负增长。

美联储将面临履行“双重使命”中促进充分就业职责的压力。然而,鲍威尔面临的一个难题是,本周将公布新的生产者价格指数(PPI)和消费者价格指数(CPI)数据,市场预期这两项数据将显示通胀继续上行。美联储“双重使命”的另一个职责是抑制通胀——正因如此,部分经济学家仍认为降息25个基点并不像股市所预期的那样板上钉钉。

德意志银行(Deutsche Bank)的吉姆·里德团队在致客户的报告中表示:“尽管美联储目前已进入静默期,但周三的PPI数据,尤其是周四的CPI数据,将提前影响市场定价。目前市场已完全消化降息25个基点的预期,但对降息50个基点并无明显预期。我们的经济学家认为,除非本周通胀数据异常疲弱,否则不会出现大幅降息。”(*)

译者:刘进龙

审校:汪皓

• Wall Street expects the Fed to cut rates by 0.25% next week, though some are speculating Jerome Powell could deliver a “jumbo” 0.5% move, given how weak recent labor market data has been. Global markets and U.S. S&P 500 futures rose on expectations of cheaper money, but there are still two more rounds of inflation data prior to the Fed’s call.

S&P 500 futures are up 0.25% this morning as investors, having digested grim data from the U.S. labor market last week, feel that a 0.25% cut in interest rates from the Fed is locked in. The talk now is whether U.S. Federal Reserve chairman Jerome Powell will surprise the markets with a “jumbo” 0.5% cut, or opt instead for a series of 0.25% cuts month by month.

The consensus is that the Fed will deliver only a 0.25% cut. But a minority of speculators—just under 10%—in the CME Fed Funds futures market think 0.5% might happen.

“The broader market psychology has shifted. Following Fed Chair Powell’s pivot at Jackson Hole, the question is no longer if the Fed will ease, but how fast,” Convera’s George Vessey said in a note this morning.

Pantheon Macroeconomics forecast three cuts of 0.25% this year; Wedbush’s Seth Basham forecast two.

With expectations of a new round of cheaper money coming down the pipe, global markets were all up this morning.

The reason investors are so sure the cuts are coming is that underneath the weak headline number from the nonfarm payroll jobs report—just 22,000 new jobs—was even weaker data from the private sector. Job growth was negative in sectors most exposed to President Trump’s trade tariffs, according to Torsten Sløk of Apollo Global Management. The revised jobs number for June was negative.

In the private sector, average job growth was only 29,000 per month from June to August, according to a note from Daiwa Capital Markets, down from an average of 100,000 per month in Q1—before the tariffs took hold:

Daiwa’s Lawrence Werther and Brendan Stuart point to another gloomy indicator: The private-sector payroll diffusion index—which surveys 258 private-sector industries—found that more companies are cutting jobs than hiring new workers. The gauge fell to 48 in August; anything below 50 indicates negative hiring.

The Fed will be under pressure to support the full employment side of its dual mandate. There’s a fly in Powell’s ointment, however. We’re going to get new numbers for the producer price index (PPI) and the consumer price index (CPI) this week, and the expectation is that they’ll show inflation continuing to go up. The other half of the Fed mandate is to fight inflation—and that’s why some economists are still saying that a 25% cut isn’t as guaranteed as the equity markets are assuming.

“Although the Fed is now on its media blackout, Wednesday’s PPI and especially Thursday’s CPI will shape pricing ahead of that,” Jim Reid’s team at Deutsche Bank told clients this morning. “So a quarter-point cut is fully priced but without much being priced in for a 50 bps move. Our economists believe you’d need to see pretty weak inflation this week to get that.”