长期以来,房地产市场一直被视为经济衰退的早期预警信号,而穆迪分析(Moody’s Analytics)首席经济学家马克·赞迪特别关注其中一项数据。

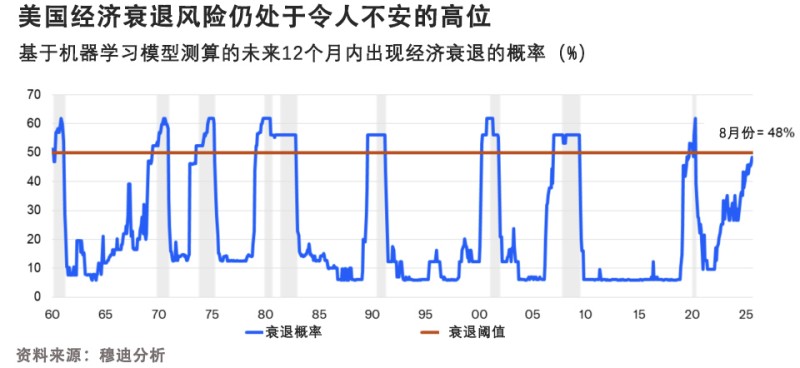

他在上周日社交媒体发文中指出,穆迪自主研发的利用机器学习技术的领先经济指标显示,未来12个月内美国出现经济衰退的概率已升至48%。

尽管这一概率尚不足50%,但赞迪指出,从历史经验来看,概率一旦达到这个高度,经济必然会陷入衰退。

房地产市场数据是穆迪指标的关键组成部分。

赞迪警告称:“该算法已将建筑许可量作为预测经济衰退的最关键经济指标。此前,尽管建筑商通过降息补贴等激励措施拉动销售,使得建筑许可量一直保持相对稳健,但未售房屋库存目前已处于高位且仍在持续上升。”

“为此,建筑商正在收缩业务,建筑许可量开始下滑,如今已跌至疫情封锁以来的最低水平。”

上个月,美国人口普查局(Census Bureau)报告显示,7月住宅建筑许可量经季节性调整后年化总量为135万套,环比下降2.8%,同比下降5.7%。

7月,赞迪特别指出房地产市场令人担忧,并将其风险等级提升至“红色警报”级别,原因是房屋销售、房屋建设以及房价都因贷款利率上升而受到挤压。。

尽管30年期固定抵押贷款利率已从近7%降至约6.3%,但目前尚不清楚这一水平是否足以提振建筑商信心,也不清楚利率还会持续下降至何种程度。赞迪上周日表示,周三即将公布的8月许可数据将成为关注焦点。

他预测:“这些数据无疑将成为美联储当天晚些时候宣布降息的又一理由。”

事实上,美联储决策者们已经开始对房地产市场感到担忧。央行7月会议纪要显示,决策者们对住房需求疲软、供应上升以及房价下跌表示担忧。

不仅住房问题引起美联储关注,决策者们还将住房问题与人工智能技术一道列为影响就业市场的潜在风险因素。

会议纪要指出:“除关税带来的风险外,与会者提到的可能对就业造成负面影响的风险还包括风险溢价上升可能导致金融环境趋紧、住房市场进一步恶化,以及职场人工智能使用增加可能导致就业减少等。”

建筑许可量并非唯一值得关注的房地产市场指标。已故经济学家埃德·利默(今年2月去世)曾在2007年发表的一篇著名论文中指出,住宅投资是预测经济衰退的最有力的指标。

就这项指标而言,当前数据也不容乐观。第二季度住宅投资暴跌4.7%,较第一季度1.3%的跌幅进一步扩大。(*)

译者:刘进龙

审校:汪皓

长期以来,房地产市场一直被视为经济衰退的早期预警信号,而穆迪分析(Moody’s Analytics)首席经济学家马克·赞迪特别关注其中一项数据。

他在上周日社交媒体发文中指出,穆迪自主研发的利用机器学习技术的领先经济指标显示,未来12个月内美国出现经济衰退的概率已升至48%。

尽管这一概率尚不足50%,但赞迪指出,从历史经验来看,概率一旦达到这个高度,经济必然会陷入衰退。

房地产市场数据是穆迪指标的关键组成部分。

赞迪警告称:“该算法已将建筑许可量作为预测经济衰退的最关键经济指标。此前,尽管建筑商通过降息补贴等激励措施拉动销售,使得建筑许可量一直保持相对稳健,但未售房屋库存目前已处于高位且仍在持续上升。”

“为此,建筑商正在收缩业务,建筑许可量开始下滑,如今已跌至疫情封锁以来的最低水平。”

上个月,美国人口普查局(Census Bureau)报告显示,7月住宅建筑许可量经季节性调整后年化总量为135万套,环比下降2.8%,同比下降5.7%。

7月,赞迪特别指出房地产市场令人担忧,并将其风险等级提升至“红色警报”级别,原因是房屋销售、房屋建设以及房价都因贷款利率上升而受到挤压。。

尽管30年期固定抵押贷款利率已从近7%降至约6.3%,但目前尚不清楚这一水平是否足以提振建筑商信心,也不清楚利率还会持续下降至何种程度。赞迪上周日表示,周三即将公布的8月许可数据将成为关注焦点。

他预测:“这些数据无疑将成为美联储当天晚些时候宣布降息的又一理由。”

事实上,美联储决策者们已经开始对房地产市场感到担忧。央行7月会议纪要显示,决策者们对住房需求疲软、供应上升以及房价下跌表示担忧。

不仅住房问题引起美联储关注,决策者们还将住房问题与人工智能技术一道列为影响就业市场的潜在风险因素。

会议纪要指出:“除关税带来的风险外,与会者提到的可能对就业造成负面影响的风险还包括风险溢价上升可能导致金融环境趋紧、住房市场进一步恶化,以及职场人工智能使用增加可能导致就业减少等。”

建筑许可量并非唯一值得关注的房地产市场指标。已故经济学家埃德·利默(今年2月去世)曾在2007年发表的一篇著名论文中指出,住宅投资是预测经济衰退的最有力的指标。

就这项指标而言,当前数据也不容乐观。第二季度住宅投资暴跌4.7%,较第一季度1.3%的跌幅进一步扩大。(*)

译者:刘进龙

审校:汪皓

The housing market is long been seen as an early warning sign for recessions, and one data point in particular has caught the attention of Moody’s Analytics chief economist Mark Zandi.

In social media posts on Sunday, he noted that Moody’s own leading economic indicator that uses machine learning has estimated the odds of a recession in the next 12 months are now at 48%.

Even though it’s less than 50%, Zandi pointed out that the probability has never been that high previously without the economy eventually slipping into a downturn.

A crucial component in the Moody’s indicator comes from the housing market.

“The algorithm has identified building permits as the most critical economic variable for predicting recessions. And while permits had been holding up reasonably well, as builders supported sales through interest rate buydowns and other incentives, inventories of unsold homes are now high and on the rise,” Zandi warned.

“In response, builders are pulling back, and permits have started to slump. They are now as low as they’ve been since the pandemic shutdowns.”

Last month, the Census Bureau reported that residential building permits in July were at a seasonally adjusted annual rate of 1.35 million, down 2.8% from the prior month and down 5.7% from a year ago.

In July, Zandi singled out the housing market for concern, escalating it to a “red flare” as home sales, homebuilding, and house prices were getting squeezed by elevated mortgage rates.

While the 30-year fixed rate has since come down from near 7% to about 6.3%, it’s not clear yet if that’s low enough to revive builders or how much it will continue to drop. On Sunday, Zandi said all eyes should be on August permit data, which will come out on Wednesday.

“They are sure to provide another reason why the Fed should and will announce a rate cut later that day,” he predicted.

In fact, Federal Reserve policymakers have already started worrying about the housing market. Minutes from the central bank’s July meeting revealed concerns about weak housing demand, rising supply, and falling home prices.

And not only did housing show up on the Fed’s radar, officials flagged it as a potential risk to jobs, along with artificial intelligence technology.

“In addition to tariff-induced risks, potential downside risks to employment mentioned by participants included a possible tightening of financial conditions due to a rise in risk premiums, a more substantial deterioration in the housing market, and the risk that the increased use of AI in the workplace may lower employment,” the minutes said.

Permits aren’t the only housing market data point to follow. The economist Ed Leamer, who passed away in February, famously published a paper in 2007 that said residential investment is the best leading indicator of an oncoming recession.

On that score, the data doesn’t look good either. In the second quarter, residential investment tumbled 4.7%, accelerating from the first quarter’s 1.3% decline