• Palantir首个季度营收突破10亿美元,这使其联合创始人及高管层财富急剧攀升。彼得·蒂尔(Peter Thiel)和亚历克斯·卡普(Alex Karp)的净资产合计增长170亿美元,而该公司首席技术官成为新晋亿万富豪。与此同时,Palantir坦言其目标是通过裁员并借助人工智能实现营收增长10倍。

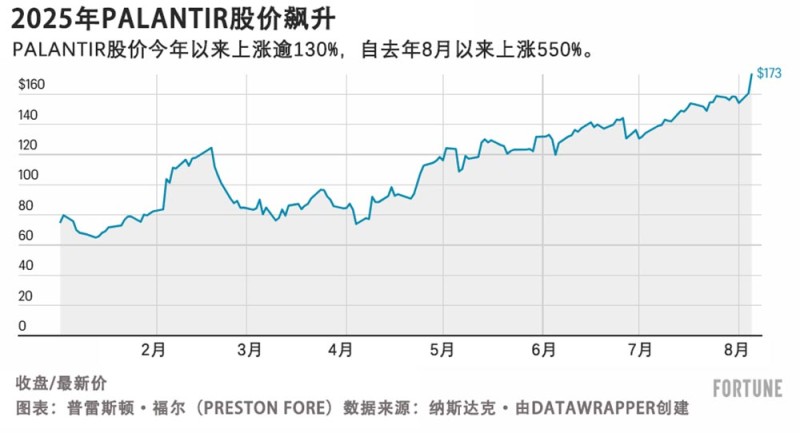

Palantir的股价已然驶入加速上扬的快车道。仅在过去一个月里,其股价飙升了约25%,助力这家人工智能与分析公司市值突破4110亿美元大关。而过去一年,该股股价更是暴涨逾550%。

对于Palantir的投资者和联合创始人而言,这波股价涨势已转化为数十亿美元的财富增值。根据彭博亿万富豪指数,联合创始人彼得·蒂尔的净资产已攀升至逾250亿美元——自1月以来增长了90亿美元,而Palantir首席执行官亚历克斯·卡普的净资产飙升至超150亿美元(今年以来增长了80亿美元)。联合创始人史蒂文·科恩(Stephen Cohen)和乔·朗斯代尔(Joe Lonsdale)也是超级富豪俱乐部的资深成员。

如今,财务上的成功已不再局限于公司创始人。首席技术官希亚姆·桑卡尔成为最新一位净资产突破10亿美元的公司高管,其净资产已超13亿美元。

该公司公布最新一个季度营收达到创纪录的10亿美元,较去年同期增长48%。利润也飙升33%,达到3.27亿美元,这促使公司将全年营收预期上调至至少41.4亿美元。

桑卡尔在近日的财报电话会议上表示,该公司的成功是20年不懈努力的成果。

《财富》杂志已联系Palantir寻求置评。

其他公司的亏损成了Palantir的收益

对于那些因特斯拉(Tesla)、苹果(Apple)和亚马逊(Amazon)等其他科技公司今年均处于亏损状态而心怀不满的投资者而言,Palantir股价增长或许是个好消息。

在联邦政府合同领域,埃森哲(Accenture)、博思艾伦咨询公司(Booz Allen)、德勤(Deloitte)等竞争对手正深陷困境,受政府效率部门削减开支影响,它们失去了重要政府合同。然而,Palantir却收获颇丰,其来自美国政府的收入同比激增53%,就在上周,还成功与美国陆军签署了一份价值高达100亿美元的软件和数据合同。

尽管考虑到蒂尔与特朗普政府关系密切,Palantir与联邦政府的合作招致诸多质疑,但该公司仍在全速前进。

“这家公司几乎不存在寄生性元素,”卡普在财报电话会议上表示。“我们拥有精简的销售团队。公司内部鲜少有冗余的琐事。我们推行扁平化管理模式,汇聚了最顶尖、最有趣的人才,他们的信念不落窠臼。”

对人工智能的持续采用也使Palantir等公司能以更少的员工完成更多工作。

“我们计划在缩减员工规模的同时实现营收增长,”卡普告诉美国消费者新闻与商业频道(CNBC),“这是一场疯狂且高效的变革。我们的目标是营收增长10倍,同时将员工数量控制在3600人。目前公司有4100名员工。”

与Palantir类似,英伟达也是造就亿万富翁的机器

和Palantir今年情形相仿,英伟达股价在2024年一路狂飙,涨幅超170%。随着两家公司持续增长,它们都踏上了造就亿万富豪的道路。

除了首席执行官黄仁勋个人资产达到1550亿美元之外,该公司首席财务官科莱特·克雷斯(Colette Kress)和执行副总裁普瑞(Jay Puri)也在上个月末成功跻身亿万富翁之列。

黄仁勋最近在风险投资家主持的《All-In》播客小组讨论中表示:“我的高管团队诞生的亿万富翁数量超过世界上任何一位首席执行官的高管团队,他们都过得相当滋润。”

英伟达约有4.2万名员工,市值约4.3万亿美元,约为Palantir的10倍。

“别为我这个层级的任何人感到难过,”黄仁勋说,“我们这个层级的人都过得相当优渥。”(*)

译者:中慧言-王芳

• Palantir首个季度营收突破10亿美元,这使其联合创始人及高管层财富急剧攀升。彼得·蒂尔(Peter Thiel)和亚历克斯·卡普(Alex Karp)的净资产合计增长170亿美元,而该公司首席技术官成为新晋亿万富豪。与此同时,Palantir坦言其目标是通过裁员并借助人工智能实现营收增长10倍。

Palantir的股价已然驶入加速上扬的快车道。仅在过去一个月里,其股价飙升了约25%,助力这家人工智能与分析公司市值突破4110亿美元大关。而过去一年,该股股价更是暴涨逾550%。

对于Palantir的投资者和联合创始人而言,这波股价涨势已转化为数十亿美元的财富增值。根据彭博亿万富豪指数,联合创始人彼得·蒂尔的净资产已攀升至逾250亿美元——自1月以来增长了90亿美元,而Palantir首席执行官亚历克斯·卡普的净资产飙升至超150亿美元(今年以来增长了80亿美元)。联合创始人史蒂文·科恩(Stephen Cohen)和乔·朗斯代尔(Joe Lonsdale)也是超级富豪俱乐部的资深成员。

如今,财务上的成功已不再局限于公司创始人。首席技术官希亚姆·桑卡尔成为最新一位净资产突破10亿美元的公司高管,其净资产已超13亿美元。

该公司公布最新一个季度营收达到创纪录的10亿美元,较去年同期增长48%。利润也飙升33%,达到3.27亿美元,这促使公司将全年营收预期上调至至少41.4亿美元。

桑卡尔在近日的财报电话会议上表示,该公司的成功是20年不懈努力的成果。

《财富》杂志已联系Palantir寻求置评。

其他公司的亏损成了Palantir的收益

对于那些因特斯拉(Tesla)、苹果(Apple)和亚马逊(Amazon)等其他科技公司今年均处于亏损状态而心怀不满的投资者而言,Palantir股价增长或许是个好消息。

在联邦政府合同领域,埃森哲(Accenture)、博思艾伦咨询公司(Booz Allen)、德勤(Deloitte)等竞争对手正深陷困境,受政府效率部门削减开支影响,它们失去了重要政府合同。然而,Palantir却收获颇丰,其来自美国政府的收入同比激增53%,就在上周,还成功与美国陆军签署了一份价值高达100亿美元的软件和数据合同。

尽管考虑到蒂尔与特朗普政府关系密切,Palantir与联邦政府的合作招致诸多质疑,但该公司仍在全速前进。

“这家公司几乎不存在寄生性元素,”卡普在财报电话会议上表示。“我们拥有精简的销售团队。公司内部鲜少有冗余的琐事。我们推行扁平化管理模式,汇聚了最顶尖、最有趣的人才,他们的信念不落窠臼。”

对人工智能的持续采用也使Palantir等公司能以更少的员工完成更多工作。

“我们计划在缩减员工规模的同时实现营收增长,”卡普告诉美国消费者新闻与商业频道(CNBC),“这是一场疯狂且高效的变革。我们的目标是营收增长10倍,同时将员工数量控制在3600人。目前公司有4100名员工。”

与Palantir类似,英伟达也是造就亿万富翁的机器

和Palantir今年情形相仿,英伟达股价在2024年一路狂飙,涨幅超170%。随着两家公司持续增长,它们都踏上了造就亿万富豪的道路。

除了首席执行官黄仁勋个人资产达到1550亿美元之外,该公司首席财务官科莱特·克雷斯(Colette Kress)和执行副总裁普瑞(Jay Puri)也在上个月末成功跻身亿万富翁之列。

黄仁勋最近在风险投资家主持的《All-In》播客小组讨论中表示:“我的高管团队诞生的亿万富翁数量超过世界上任何一位首席执行官的高管团队,他们都过得相当滋润。”

英伟达约有4.2万名员工,市值约4.3万亿美元,约为Palantir的10倍。

“别为我这个层级的任何人感到难过,”黄仁勋说,“我们这个层级的人都过得相当优渥。”(*)

译者:中慧言-王芳

• Palantir’s first billion-dollar quarter is dramatically increasing the wealth of the company’s cofounders and C-suite. Peter Thiel and Alex Karp have each seen their net worth jump by $17 billion collectively—and the company’s chief technology officer is the latest to join the billionaires club. This comes as Palantir admits its goal is to cut jobs—but grow revenue by 10x thanks to AI.

Palantir’s stock has hit turbo mode. In the last month alone, shares surged by some 25%, helping the AI and analytics company reach a market cap north of $411 billion. And over the last year, the stock has skyrocketed by more than 550%.

For Palantir’s investors and cofounders, this surge has translated to wealth racking up by the billions. Cofounder Peter Thiel’s net worth has jumped to over $25 billion—up $9 billion since January—and Palantir CEO Alex Karp’s has surged to more than $15 billion (up $8 billion YTD), according to Bloomberg’s Billionaire Index. Cofounders Stephen Cohen and Joe Lonsdale are also long-time members of the ultra-rich club.

Now, the financial wins are extending beyond the company’s founders. Chief technology officer Shyam Sankar became its latest exec to cross the billion-dollar mark on Monday, with his net worth climbing past $1.3 billion.

Later that day, the company reported a record-setting $1 billion in revenue for its most recent quarter, up 48% year-over-year. Profit also soared by 33% to $327 million, prompting the company to increase its full-year revenue outlook to at least $4.14 billion.

The company’s successes have been 20 years in the making, Sankar said on Monday’s earnings call.

Fortune reached out to Palantir for comment.

Other companies’ losses are Palantir’s gains

Palantir’s stock growth is likely welcomed news for investors who have been unsatisfied with the performance of other tech companies like Tesla, Apple, and Amazon, which are all in the red this year.

Competitors in the federal contracting space have also struggled, with firms like Accenture, Booz Allen and Deloitte losing key government contracts amid Department of Government Efficiency cuts. However, Palantir has largely gained, with earnings from the U.S. government growing by 53% year-over-year. Just last week, the company landed a $10 billion software and data contract with the Army.

And while Palantir’s partnerships with the federal government have raised eyebrows considering Thiel’s close relationship with the Trump administration, the company is only moving full speed ahead.

“There are almost no parasitic elements to this company,” Karp said in the earnings call on Monday. “We have a small sales force. We have very little BS internally. We have a flat hierarchy. We have the most qualified and interesting people, heterodox in their beliefs.”

A continued embrace of AI is also making it easier for companies like Palantir to do more with less workers.

“We’re planning to grow our revenue … while decreasing our number of people,” Karp told CNBC. “This is a crazy, efficient revolution. The goal is to get 10x revenue and have 3,600 people. We have now 4,100.”

Like Palantir, Nvidia is a billionaire-producing machine

Like Palantir this year, Nvidia’s stock skyrocketed in 2024—with gains topped 170%. And as each company continues to grow, they’re both on the billionaire-producing track.

On top of CEO Jensen Huang’s own $155 billion, his chief financial officer Colette Kress and EVP Jay Puri joined the billionaire’s club late last month.

“I’ve created more billionaires on my management team than any CEO in the world,” Huang said recently during a panel hosted by venture capitalists running the All-In podcast. “They’re doing just fine.”

Nvidia has about 42,000 and a market cap of about $4.3 trillion, about 10x that of Palantir.

“Don’t feel sad for anybody at my layer,” Huang said. “My layer is doing just fine.”