顶尖投行对美国经济给出了惊人判断:长期作为韧性支柱的劳动力市场可能面临大麻烦。最近经济展望中,乔纳森·平格尔领导的瑞银(UBS)经济学家描绘了一幅远超表面就业数据的疲软图景,而且警告称,家庭和更广泛的经济复苏面临的风险日益增加。

瑞士投行这份题为《美国经济周报》(US Economics Weekly)的报告发布之际,美国联邦政府停摆即将结束,市场屏息以待。由于政府停摆,经济学家和市场观察者已连续40多天无法获取关键官方数据。10月末美国劳工统计局(Bureau of Labor Statistics)前局长埃里卡・格罗申将这种状态比作“盲飞”。平格尔团队表示,若政府重启,预计下周将公布9月就业数据,以及10月CPI通胀报告。

经济学家比以往更需要这些数据。今年大部分时间里,美联储主席杰罗姆・鲍威尔等顶尖学者都表示,美国处于“低招聘、低裁员”市场,即雇主招聘意愿低迷,也不愿意裁员,或许仍未从疫情期间“大辞职潮”中恢复。如今,华尔街不只瑞银一家投行开始怀疑“低裁员”这一前提是否成立。

花旗经济学家维罗妮卡・克拉克告诉彭博(Bloomberg):“现在有大量劳动力可用,总体上企业可能认为没必要留住员工超过必要时间。”

与此同时,安联贸易美洲公司(Allianz Trade Americas)高级经济学家丹・诺斯也告诉彭博:“已有大量成熟企业大规模裁员。”

裁员凶猛且再就业困难

瑞银指出,实际裁员情况官方口径更为严重。依据包括失业保险申请量、企业裁员公告以及《工人调整与再培训通知法案》(WARN)通知数量,全都高于疫情前水平;就连滞后但被视为“黄金标准”的商业就业动态数据也显示,在截至最新数据的时间里岗位流失速度已达到甚至超过疫情前。

确实,裁员速度急剧加快。根据行业标准Challenger, Gray & Christmas的数据,10月企业宣布裁员人数达到15.7万,为2020年7月以来月度最高值。科技和仓储行业受到的冲击特别严重,裁员与自动化和人工智能也有关系。

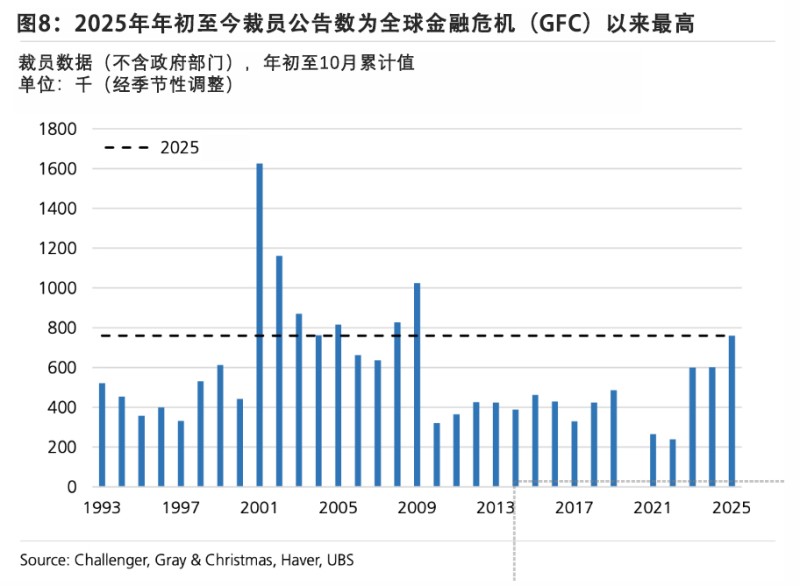

今年以来的总数如何?截至10月,经季节性调整的裁员人数高达76万人,远超2024年同期,也是2009年即全球金融危机以来最高水平。多家大企业纷纷采取行动,亚马逊削减1.4万个企业职位,UPS过去一年裁员4.8万人,塔吉特(Target)一次裁掉近2000名员工。

“浴缸”风险与招聘疲软

被裁员工正涌入日益庞大的失业大军。瑞银把就业市场比作浴缸,出水管(裁员)流速稳定,进水管(招聘)变缓,水位(岗位总数)必然下降。多项商业调查显示,招聘率已降至历史上衰退期才会出现的水平。若剔除相对稳定的医护与社会救助行业,私营部门就业人数平均每月减少3.6万个。

今年年初至8月,政府主要调查统计的家庭就业人数每月减少约7.2万个。这一增速“远低于”维持人口增长所需水平,更不用说维持稳定的失业率,而失业率已攀升至2021年以来最高。劳动力参与率有所下滑,超过80万人退出了劳动力市场但表示仍然希望工作。

经济学家指出,最广泛的就业不足指标即U-6指标1月以来已上升0.6个百分点,达到8.1%,比2019年底高出1.3个百分点。值得注意的是,这一增长不仅源于失业人口增加。越来越多美国人因经济原因从事兼职工作,这是需求疲软的又一典型信号。“这与特朗普政府声称的移民限制将收紧劳动力市场正好相反。如果劳动力供给因移民政策减少,本不应出现这种情况,”瑞银写道。

职位空缺持续减少。截至10月底,Indeed.com报告称职位发布数量已降至2021年以来最低水平,几乎所有行业都出现了同比下滑。与此同时,每周首次申请失业保险的平均人数高于2023年水平,持续申请人数也接近疫情后最高点。

平格尔指出,即便看似有效的职位空缺,可能只是做做样子并未实际招聘。

招聘率与衰退时期的水平一致,且缺口“非常大,似乎很多职位空缺并未得到积极填补,”平格尔表示。“也可以看看1400万不工作但希望就业或正在求职的人群,或者200万领取失业救济金的人群。由于劳动力供给充足,至少部分职位空缺的招聘意愿并不迫切。”

假日招聘萎缩与信心下滑

不仅劳动者面临失业,新的就业机会也在减少。假日季临时招聘计划远低于疫情前水平。Challenger, Gray & Christmas报告称,9月和10月宣布的假日岗位仅40万个,远低于2014年至2019年期间的平均62.5万个,甚至低于近年水平。塔吉特等主要零售商甚至不愿披露招聘数据,美国零售联合会(National Retail Federation)称,假日季岗位可能较去年减少40%。

寒意正冲击消费者和企业信心。密歇根大学11月消费者信心指数降至50.3,仅略高于2022年的历史最低点。表示工作机会充足的家庭越来越少,预计未来一年失业率将上升的家庭比例已飙升至1980年代经济衰退时期以来最高水平。小企业层面,在通胀担忧和劳动力市场持续动荡的背景下,乐观情绪“难以回升”。

美联储的政策抉择

美联储官员内部分歧日益加剧,一些政策制定者警告称,就业风险已与通胀担忧不相上下。尽管有人主张降息以缓冲劳动力市场冲击,但也有人担心通胀尚未得到完全控制。一位美联储理事坦言,她担心“劳动力市场可能迅速恶化”,呼吁每组新经济数据发布时都要保持谨慎和政策灵活性。

瑞银的结论如何?如果裁员持续而招聘继续放缓,劳动力市场将出现“更明显的收缩”。报告作者警告称,这种情况可能很快会影响家庭信心以及消费者支出,进而危及经济复苏。“如果浴缸排水速度越来越快,而水龙头流量不变,水位必然会下降。这对经济前景会造成重大风险。”(*)

译者:梁宇

审校:夏林

顶尖投行对美国经济给出了惊人判断:长期作为韧性支柱的劳动力市场可能面临大麻烦。最近经济展望中,乔纳森·平格尔领导的瑞银(UBS)经济学家描绘了一幅远超表面就业数据的疲软图景,而且警告称,家庭和更广泛的经济复苏面临的风险日益增加。

瑞士投行这份题为《美国经济周报》(US Economics Weekly)的报告发布之际,美国联邦政府停摆即将结束,市场屏息以待。由于政府停摆,经济学家和市场观察者已连续40多天无法获取关键官方数据。10月末美国劳工统计局(Bureau of Labor Statistics)前局长埃里卡・格罗申将这种状态比作“盲飞”。平格尔团队表示,若政府重启,预计下周将公布9月就业数据,以及10月CPI通胀报告。

经济学家比以往更需要这些数据。今年大部分时间里,美联储主席杰罗姆・鲍威尔等顶尖学者都表示,美国处于“低招聘、低裁员”市场,即雇主招聘意愿低迷,也不愿意裁员,或许仍未从疫情期间“大辞职潮”中恢复。如今,华尔街不只瑞银一家投行开始怀疑“低裁员”这一前提是否成立。

花旗经济学家维罗妮卡・克拉克告诉彭博(Bloomberg):“现在有大量劳动力可用,总体上企业可能认为没必要留住员工超过必要时间。”

与此同时,安联贸易美洲公司(Allianz Trade Americas)高级经济学家丹・诺斯也告诉彭博:“已有大量成熟企业大规模裁员。”

裁员凶猛且再就业困难

瑞银指出,实际裁员情况官方口径更为严重。依据包括失业保险申请量、企业裁员公告以及《工人调整与再培训通知法案》(WARN)通知数量,全都高于疫情前水平;就连滞后但被视为“黄金标准”的商业就业动态数据也显示,在截至最新数据的时间里岗位流失速度已达到甚至超过疫情前。

确实,裁员速度急剧加快。根据行业标准Challenger, Gray & Christmas的数据,10月企业宣布裁员人数达到15.7万,为2020年7月以来月度最高值。科技和仓储行业受到的冲击特别严重,裁员与自动化和人工智能也有关系。

今年以来的总数如何?截至10月,经季节性调整的裁员人数高达76万人,远超2024年同期,也是2009年即全球金融危机以来最高水平。多家大企业纷纷采取行动,亚马逊削减1.4万个企业职位,UPS过去一年裁员4.8万人,塔吉特(Target)一次裁掉近2000名员工。

“浴缸”风险与招聘疲软

被裁员工正涌入日益庞大的失业大军。瑞银把就业市场比作浴缸,出水管(裁员)流速稳定,进水管(招聘)变缓,水位(岗位总数)必然下降。多项商业调查显示,招聘率已降至历史上衰退期才会出现的水平。若剔除相对稳定的医护与社会救助行业,私营部门就业人数平均每月减少3.6万个。

今年年初至8月,政府主要调查统计的家庭就业人数每月减少约7.2万个。这一增速“远低于”维持人口增长所需水平,更不用说维持稳定的失业率,而失业率已攀升至2021年以来最高。劳动力参与率有所下滑,超过80万人退出了劳动力市场但表示仍然希望工作。

经济学家指出,最广泛的就业不足指标即U-6指标1月以来已上升0.6个百分点,达到8.1%,比2019年底高出1.3个百分点。值得注意的是,这一增长不仅源于失业人口增加。越来越多美国人因经济原因从事兼职工作,这是需求疲软的又一典型信号。“这与特朗普政府声称的移民限制将收紧劳动力市场正好相反。如果劳动力供给因移民政策减少,本不应出现这种情况,”瑞银写道。

职位空缺持续减少。截至10月底,Indeed.com报告称职位发布数量已降至2021年以来最低水平,几乎所有行业都出现了同比下滑。与此同时,每周首次申请失业保险的平均人数高于2023年水平,持续申请人数也接近疫情后最高点。

平格尔指出,即便看似有效的职位空缺,可能只是做做样子并未实际招聘。

招聘率与衰退时期的水平一致,且缺口“非常大,似乎很多职位空缺并未得到积极填补,”平格尔表示。“也可以看看1400万不工作但希望就业或正在求职的人群,或者200万领取失业救济金的人群。由于劳动力供给充足,至少部分职位空缺的招聘意愿并不迫切。”

假日招聘萎缩与信心下滑

不仅劳动者面临失业,新的就业机会也在减少。假日季临时招聘计划远低于疫情前水平。Challenger, Gray & Christmas报告称,9月和10月宣布的假日岗位仅40万个,远低于2014年至2019年期间的平均62.5万个,甚至低于近年水平。塔吉特等主要零售商甚至不愿披露招聘数据,美国零售联合会(National Retail Federation)称,假日季岗位可能较去年减少40%。

寒意正冲击消费者和企业信心。密歇根大学11月消费者信心指数降至50.3,仅略高于2022年的历史最低点。表示工作机会充足的家庭越来越少,预计未来一年失业率将上升的家庭比例已飙升至1980年代经济衰退时期以来最高水平。小企业层面,在通胀担忧和劳动力市场持续动荡的背景下,乐观情绪“难以回升”。

美联储的政策抉择

美联储官员内部分歧日益加剧,一些政策制定者警告称,就业风险已与通胀担忧不相上下。尽管有人主张降息以缓冲劳动力市场冲击,但也有人担心通胀尚未得到完全控制。一位美联储理事坦言,她担心“劳动力市场可能迅速恶化”,呼吁每组新经济数据发布时都要保持谨慎和政策灵活性。

瑞银的结论如何?如果裁员持续而招聘继续放缓,劳动力市场将出现“更明显的收缩”。报告作者警告称,这种情况可能很快会影响家庭信心以及消费者支出,进而危及经济复苏。“如果浴缸排水速度越来越快,而水龙头流量不变,水位必然会下降。这对经济前景会造成重大风险。”(*)

译者:梁宇

审校:夏林

A leading investment bank has delivered an arresting diagnosis of the U.S. economy: the labor market, long a pillar of resilience, may be in real trouble. In their latest economic outlook, UBS economists led by Jonathan Pingle painted a picture of mounting weakness that extends well beyond headline job numbers, warning of a growing risk to households and the broader recovery.

The latest “US Economics Weekly” note from the Swiss investment bank came with bated breath ahead of the impending end of the federal government shutdown. Economists and market-watchers have been deprived of federal economic data for over 40 days, something that former Bureau of Labor Statistics commissioner Erica Groshen likened to “flying blind” in late October. If the government does reopen, Pingle’s team said it expects jobs data for September to be released next week, and potentially the October inflation report, the Consumer Price Index.

Economists need that data now more than ever. For much of the year, top economists, including Fed Chair Jerome Powell, have said we’re in a “low hire, low fire” jobs market. For much of the year, employers were laconic in hiring, and seemed afraid to fire their workers; perhaps still wounded from the pandemic-era “Great Resignation.” UBS isn’t alone on Wall Street in worrying that, maybe the “low-fire” part of the equation isn’t quite true anymore.

Now, “there are plenty of available workers that, on the whole, businesses probably don’t feel the need to hold on to workers for longer than necessary,” Veronica Clark, a Citigroup Inc. economist, told Bloomberg.

Meanwhile, Dan North, senior economist at Allianz Trade Americas, also told Bloomberg that “you’ve got a substantial number of well-established companies making pretty big head cuts.”

People are getting laid off and not hired again

Firing is running higher than advertised, UBS argued, citing the fact that “unemployment insurance claims, layoff announcements and WARN notices have all been running ahead of the pre-pandemic pace. Even the lagged Business Employment Dynamics data, the gold standard of data on job creation and job destruction dynamics has been showing the pace of job loss at or above the pre-pandemic pace through the latest data.”

Indeed, cuts have accelerated sharply. October saw 157,000 layoffs announced by corporations, per industry standard Challenger, Gray & Christmas, the highest monthly total since July 2020. Technology and warehousing were hit especially hard, with cuts also linked to automation and artificial intelligence.

The year-to-date tally? A startling 760,000 seasonally adjusted cuts through October, far outpacing the same period in 2024 and running higher than any year since 2009 — the aftermath of the Great Financial Crisis. Major companies are taking action: Amazon cut 14,000 corporate roles, UPS has slashed 48,000 jobs over the past year, and Target eliminated nearly 2,000 staff in a single sweep.

‘Bathtub’ risk and weak hiring

Workers are getting thrown into a growing pool of others not finding jobs. UBS likens the job market to a bathtub: with outflows (layoffs) steady and inflows (hiring) slowing, the water level (total jobs) is bound to fall. The hiring rate, as measured by multiple business surveys, has dropped to levels historically seen only in recessions. Excluding healthcare and social assistance, which have been relatively steady, private-sector payrolls have been declining by an average of 36,000 jobs per month.

Since the start of the year, household employment as measured by the main government survey has been falling by about 72,000 jobs per month through August. Such a pace is “well below” the rate required to keep up with population growth, let alone maintain a stable unemployment rate, which has now crept up to a post-2021 high. Labor force participation has slipped, and more than 800,000 people have left the labor force but say they still want a job.

Economists note the broadest measure of underemployment, known as U-6, has jumped by 0.6 percentage points since January to 8.1%. That’s now 1.3 percentage points higher than at the end of 2019. Notably, the rise isn’t just about people out of work: more Americans are working part-time for economic reasons, another classic sign of slackening demand. “That is exactly the opposite of what should happen under a negative labor supply shock stemming from immigration,” UBS wrote, referring to the Trump administration’s argument that immigration restrictions would tighten the labor market.

Job openings continue to decline: as of the end of October, Indeed.com reported that postings had sunk to their lowest level since 2021, with almost every sector seeing year-over-year drops. Meanwhile, the weekly average of initial unemployment claims is running above 2023’s level and continuing claims are nearing a post-pandemic high.

And even the openings that appear active, Pingle argued, may not be tied to real hiring efforts.

The hiring rate “consistent with recession” has been a gap “so large that seemingly many of the openings probably are not seeing much effort to be filled,” according to Pingle. “We can also look at the 14 million people not working but who want a job or are searching for one, or the 2 million collecting unemployment benefits. Given that abundance, it would seem that at least some of the openings do not appear anxious to be filled.”

Holiday hiring and sentiment plunge

Not only are workers losing jobs, but the market for new opportunities is shrinking as well. Seasonal hiring plans for the holidays are running well below pre-pandemic norms. Challenger, Gray & Christmas reports a combined September/October total of just 400,000 announced holiday roles — sharply lower than the 625,000 average for the 2014–19 period and even below recent years. Key retailers like Target aren’t even disclosing numbers, and the National Retail Federation suggests seasonal jobs could be down 40% from a year ago.

This chill is hitting consumer and business sentiment. The University of Michigan’s consumer confidence reading dropped to 50.3 in November, barely above the all-time low set in 2022. Fewer households report jobs are plentiful, and the share expecting unemployment to rise over the next year has soared to levels not seen since the recession-scarred 1980s. Among small businesses, optimism is “struggling to gain traction” amid inflation fears and continued labor market turmoil.

The Fed weighs its options

Federal Reserve officials are increasingly divided, with some policymakers warning that the risk to jobs now rivals concerns about inflation. While some see an argument for interest rate cuts to buffer the labor market, others worry inflation isn’t yet tamed. One Fed governor admitted she worries because “the labor market can deteriorate very quickly,” calling for caution and flexibility as each new set of economic data is released.

The investment bank’s conclusion? If layoffs keep pace and hiring continues to slow, the labor market is headed for “more obvious contraction.” And that, they warn, could soon filter down to undermine household confidence, consumer spending — and the entire recovery. “If a bathtub is draining faster and faster while the faucet isn’t changed, eventually the water level is going to start to drop. That is a material risk to the outlook.”