牛市刚迎来三周年纪念,华尔街顶级分析师们却开始提出此前难以想象的质疑:推动这场大涨行情的强劲动力——人工智能,实际上是否反而会拖累美国经济增长?普遍的共识是,人工智能必将带来生产力的巨大飞跃,正是这种预期推动数千亿美元交易,掀起一场19世纪风格(或20世纪90年代末风格)的基础设施建设热潮。这引发了人们对泡沫形成的担忧,连杰夫·贝佐斯(Jeff Bezos)近期也表示:“这某种程度上是基础设施泡沫”,并非纯粹由金融投机驱动,其效益将持续多年甚至数代人。

美国银行全球研究部高级美国经济学家阿迪蒂亚·巴夫(Aditya Bhave)表示:“似乎无论走到哪里,都绕不开人工智能话题。”其团队在上周五讨论了这一话题。他们表示:“人工智能是当下人人热议的话题。”

据巴夫团队透露,在美国银行与客户的讨论中,“最常讨论的话题之一是人工智能及其对增长、生产力和劳动力市场的影响”。他们得出的结论是,目前并无证据表明人工智能的应用引发了失业潮,尤其是在白领领域。“至少到目前为止,人工智能推动生产力提升的说法似乎更站得住脚。”但摩根士丹利财富管理部门的丽莎·沙利特(Lisa Shalett)和瑞银(UBS)的保罗·唐纳文(Paul Donovan)对此持保留态度。

摩根士丹利财富管理部门首席投资官沙利特此前告诉《财富》杂志,她对人工智能领域的泡沫现象“深感忧虑”,并在10月1日的一份研究报告中重申,这波涨势已进入“第七局”。随着这场比赛接近尾声,摩根士丹利全球投资委员会道出了萦绕在他们心头的三大隐忧:所谓的超大规模企业在自由现金流增长方面面临的挑战、投机性交易,以及最后一点——“核心收入板块增速放缓”。

瑞银财富管理部门全球首席经济学家保罗·唐纳文上周五撰文指出,一个简单问题正困扰着市场:“人工智能是否正在对美国经济增长造成损害?”他指出,围绕人工智能的“狂热”情绪“应基于这样一种预期,即当下的投资将在未来带来更高的经济产出”,从这个角度来看,人工智能无疑对长期经济增长大有裨益。换言之,问题的症结更近在眼前——恰是沙利特担忧的最后两点。

专家们的争论日益激烈

唐纳文的分析涵盖了数据中心对经济增长的推动作用:这些标志性设施带动建筑工人、程序员等群体投身经济活动,助力美国经济增长。但他指出:“人工智能可能通过转移资源的方式抑制当前增长。”例如,他援引了彭博社的研究,该研究显示,数据中心对电力的需求会推高区域电价,致使消费者电费大幅攀升,进而减少了他们在其他经济领域的支出。同样,高能耗企业也将面临成本上升。唐纳文警告这可能“撕裂经济增长叙事”,因为这种动态或将迫使部分当前盈利的企业走向倒闭。换言之,难道为了维持数据中心运转,本地小企业就必须走向消亡吗?

摩根士丹利的沙利特则提出了不同的担忧,即使是所谓充满活力的新型人工智能企业,当前增速也并不理想。她将此归咎于“市场饱和或垄断——如在搜索和数字广告领域所见的那样——以及日益激烈的竞争”,并以云服务为例说明:新入局者正通过价格战争夺市场份额。她还担心大量风险资本涌入新兴商业模式,并建议投资者重新考虑对小盘股和亏损科技公司的投资敞口。

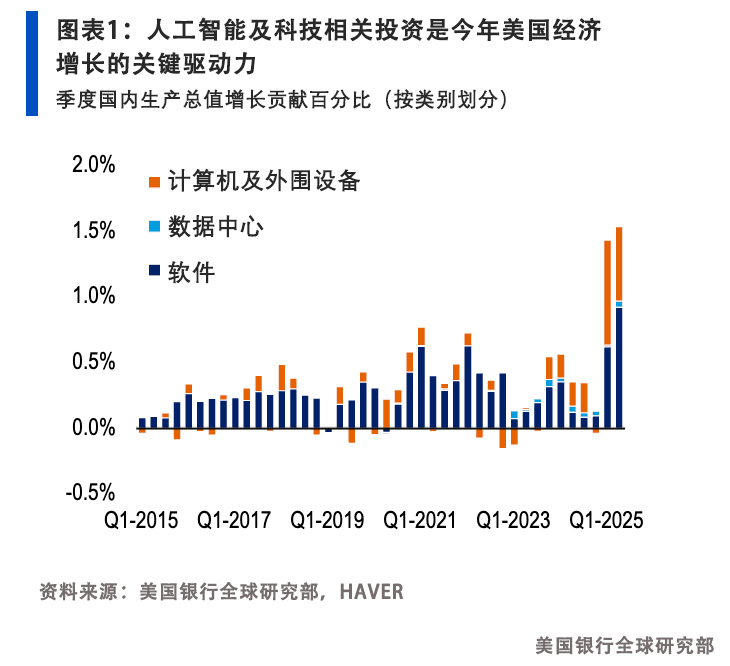

巴夫的团队总体上更为乐观。尽管他们承认中期风险仍然存在,但认为至少目前来看,人工智能对增长仍呈“净正向”影响。只需看看上半年的国内生产总值数据便可知,其表现甚至超出美国银行相对乐观的预期。在特朗普关税冲击导致第一季度“进口缺失问题”使经济数据“略显模糊”的情况下,年化增长率仍反弹至1.6%,“展现出非凡韧性”。他们指出,人工智能领域的投资正成为推动经济向前发展的巨大动力。

巴夫团队援引负责半导体板块分析的高级分析师维韦克·阿亚(Vivek Arya)的乐观预测:尽管人们对中期经济形势存在担忧,但资本支出仍是推动国内生产总值增长的动力。阿亚此前在接受《财富》杂志采访时表示,他认为这种紧张情绪与每年的特定时期有关,即第四季度的关键节点,因为大多数企业开始展望未来。经济学家欧文·拉蒙特(Owen Lamont)称之为市场“恐慌季”,而沙利特本人也指出,标准普尔500指数近期成功打破了历史上表现疲软的“九月魔咒”,逆势上涨近3%。

阿亚告诉《财富》杂志,美国银行观察到“往年此时……人们对来年的支出规模感到担忧,这也在情理之中”。他补充道,在2025年初,客户预计云服务资本支出仅会增长约20%左右,但实际增幅已飙升至50%-60%,远超预期。“但如今,人们又开始为来年及之后几年的情况感到担忧了。”

另一位发声者是哈佛大学教授、前奥巴马政府经济学家杰森·福尔曼(Jason Furman)。他在九月下旬测算得出,若剔除数据中心因素,国内生产总值数据将呈现截然不同的面貌。扣除所有资本支出后,2025年上半年国内生产总值年化增长率仅为0.1%。针对唐纳文的观点,其他一些生产性活动可能会填补这一空缺,弗曼补充道:“若没有人工智能热潮,我们可能享有更低的利率和电价,从而推动其他领域实现额外增长。粗略估算,这部分增长或许能填补人工智能热潮催生的增长中约一半的份额。”尽管如此,人工智能与经济增长的关系并非简单明了。(*)

译者:中慧言-王芳

牛市刚迎来三周年纪念,华尔街顶级分析师们却开始提出此前难以想象的质疑:推动这场大涨行情的强劲动力——人工智能,实际上是否反而会拖累美国经济增长?普遍的共识是,人工智能必将带来生产力的巨大飞跃,正是这种预期推动数千亿美元交易,掀起一场19世纪风格(或20世纪90年代末风格)的基础设施建设热潮。这引发了人们对泡沫形成的担忧,连杰夫·贝佐斯(Jeff Bezos)近期也表示:“这某种程度上是基础设施泡沫”,并非纯粹由金融投机驱动,其效益将持续多年甚至数代人。

美国银行全球研究部高级美国经济学家阿迪蒂亚·巴夫(Aditya Bhave)表示:“似乎无论走到哪里,都绕不开人工智能话题。”其团队在上周五讨论了这一话题。他们表示:“人工智能是当下人人热议的话题。”

据巴夫团队透露,在美国银行与客户的讨论中,“最常讨论的话题之一是人工智能及其对增长、生产力和劳动力市场的影响”。他们得出的结论是,目前并无证据表明人工智能的应用引发了失业潮,尤其是在白领领域。“至少到目前为止,人工智能推动生产力提升的说法似乎更站得住脚。”但摩根士丹利财富管理部门的丽莎·沙利特(Lisa Shalett)和瑞银(UBS)的保罗·唐纳文(Paul Donovan)对此持保留态度。

摩根士丹利财富管理部门首席投资官沙利特此前告诉《财富》杂志,她对人工智能领域的泡沫现象“深感忧虑”,并在10月1日的一份研究报告中重申,这波涨势已进入“第七局”。随着这场比赛接近尾声,摩根士丹利全球投资委员会道出了萦绕在他们心头的三大隐忧:所谓的超大规模企业在自由现金流增长方面面临的挑战、投机性交易,以及最后一点——“核心收入板块增速放缓”。

瑞银财富管理部门全球首席经济学家保罗·唐纳文上周五撰文指出,一个简单问题正困扰着市场:“人工智能是否正在对美国经济增长造成损害?”他指出,围绕人工智能的“狂热”情绪“应基于这样一种预期,即当下的投资将在未来带来更高的经济产出”,从这个角度来看,人工智能无疑对长期经济增长大有裨益。换言之,问题的症结更近在眼前——恰是沙利特担忧的最后两点。

专家们的争论日益激烈

唐纳文的分析涵盖了数据中心对经济增长的推动作用:这些标志性设施带动建筑工人、程序员等群体投身经济活动,助力美国经济增长。但他指出:“人工智能可能通过转移资源的方式抑制当前增长。”例如,他援引了彭博社的研究,该研究显示,数据中心对电力的需求会推高区域电价,致使消费者电费大幅攀升,进而减少了他们在其他经济领域的支出。同样,高能耗企业也将面临成本上升。唐纳文警告这可能“撕裂经济增长叙事”,因为这种动态或将迫使部分当前盈利的企业走向倒闭。换言之,难道为了维持数据中心运转,本地小企业就必须走向消亡吗?

摩根士丹利的沙利特则提出了不同的担忧,即使是所谓充满活力的新型人工智能企业,当前增速也并不理想。她将此归咎于“市场饱和或垄断——如在搜索和数字广告领域所见的那样——以及日益激烈的竞争”,并以云服务为例说明:新入局者正通过价格战争夺市场份额。她还担心大量风险资本涌入新兴商业模式,并建议投资者重新考虑对小盘股和亏损科技公司的投资敞口。

巴夫的团队总体上更为乐观。尽管他们承认中期风险仍然存在,但认为至少目前来看,人工智能对增长仍呈“净正向”影响。只需看看上半年的国内生产总值数据便可知,其表现甚至超出美国银行相对乐观的预期。在特朗普关税冲击导致第一季度“进口缺失问题”使经济数据“略显模糊”的情况下,年化增长率仍反弹至1.6%,“展现出非凡韧性”。他们指出,人工智能领域的投资正成为推动经济向前发展的巨大动力。

巴夫团队援引负责半导体板块分析的高级分析师维韦克·阿亚(Vivek Arya)的乐观预测:尽管人们对中期经济形势存在担忧,但资本支出仍是推动国内生产总值增长的动力。阿亚此前在接受《财富》杂志采访时表示,他认为这种紧张情绪与每年的特定时期有关,即第四季度的关键节点,因为大多数企业开始展望未来。经济学家欧文·拉蒙特(Owen Lamont)称之为市场“恐慌季”,而沙利特本人也指出,标准普尔500指数近期成功打破了历史上表现疲软的“九月魔咒”,逆势上涨近3%。

阿亚告诉《财富》杂志,美国银行观察到“往年此时……人们对来年的支出规模感到担忧,这也在情理之中”。他补充道,在2025年初,客户预计云服务资本支出仅会增长约20%左右,但实际增幅已飙升至50%-60%,远超预期。“但如今,人们又开始为来年及之后几年的情况感到担忧了。”

另一位发声者是哈佛大学教授、前奥巴马政府经济学家杰森·福尔曼(Jason Furman)。他在九月下旬测算得出,若剔除数据中心因素,国内生产总值数据将呈现截然不同的面貌。扣除所有资本支出后,2025年上半年国内生产总值年化增长率仅为0.1%。针对唐纳文的观点,其他一些生产性活动可能会填补这一空缺,弗曼补充道:“若没有人工智能热潮,我们可能享有更低的利率和电价,从而推动其他领域实现额外增长。粗略估算,这部分增长或许能填补人工智能热潮催生的增长中约一半的份额。”尽管如此,人工智能与经济增长的关系并非简单明了。(*)

译者:中慧言-王芳

The bull market just celebrated its third anniversary, and top analysts on Wall Street are beginning to voice the previously unthinkable: Is artificial intelligence, the dynamo powering the great rally, actually kind of bad for economic growth? The consensus holds that AI will inevitably deliver large productivity gains, and that’s powered deals worth hundreds of billions of dollars into a throwback, 19th-century-style (or late-1990s-style) infrastructure boom. This has led to fears of bubble formation, with even Jeff Bezos saying recently, “[It’s] kind of an infrastructure bubble,” not one purely driven by financial speculation, and it will pay off for years, even generations.

“It seems you can’t go anywhere without talking about AI,” according to Aditya Bhave, senior U.S. economist at Bank of America Global Research, whose team tackled the subject on Friday. “AI: It’s what everyone is talking about,” they said.

In BofA’s client discussions, according to Bhave’s team, “one of the most frequently discussed topics is AI and what it means for growth, productivity, and the labor market.” They concluded that they have not found evidence of AI usage leading to job losses, especially across white-collar occupations. “The productivity story seems to be winning, at least so far.” Morgan Stanley Wealth Management’s Lisa Shalett and UBS’s Paul Donovan aren’t so sure.

Shalett, chief investment officer for Morgan Stanley Wealth Management, previously told Fortune she was “very concerned” about bubbly conditions around AI, and reiterated in an Oct. 1 research note that the rally is in its “seventh inning.” Morgan Stanley’s Global Investment Committee flagged three concerns on their mind as the ball game nears its end: challenges in free cash flow growth among the so-called hyperscalers, speculative deal-making, and, finally, “slowing growth in key revenue segments.”

Paul Donovan, global chief economist for UBS Wealth Management, wrote on Friday that a simple question is haunting markets: “Is AI hurting growth?” He noted “the exuberance” around it, which “should be based on an expectation that investing today will generate higher economic output in the future,” and in that sense, AI is surely good for long-term growth. The problem, in other words, is closer to home, in those last two innings Shalett has been worrying about.

Growing debate among experts

Donovan’s analysis includes boosts to growth from the now-archetypal data centers leading to economic activity from construction workers, programmers, and so forth, which have helped lift U.S. growth. “But AI potentially lowers current growth by diverting resources,” he said. For example, he cited research by Bloomberg showing that as regional electricity prices are pushed higher by the power needs of data centers, the spiking bill for consumers results in less money to spend elsewhere in the economy. Likewise, energy-intensive businesses will face higher costs, too. This risks “creating a gap in the economic growth story,” Donovan said, because this dynamic could force some currently economically productive businesses to close. In other words, does the local small business have to die so the data center can live?

Morgan Stanley’s Shalett flags a different concern, that even the supposedly dynamic new AI-based businesses just aren’t growing so fast right now. She blames “market saturation or monopolies—as seen in search and digital advertising—and increasing competition,” citing cloud services, where new entrants are competing on price in a battle for market share. She’s also worried about huge amounts of venture capital flocking to fledgling business models, and advised investors to rethink their exposure to small-cap and unprofitable tech firms.

Bhave’s team is generally more bullish. While allowing that risks aren’t off the table in the medium term, they argue that, for now at least, AI appears to be a “net positive” for growth. Just look at the GDP figures from the first half, which surprised even BofA’s relatively optimistic expectations. The rebound to an annualized rate of 1.6% is “particularly resilient considering the missing imports problem” in the first quarter owing to the Trump tariff shock, which “blurs the picture” a bit. Investment in AI is just a huge force driving the economy forward, they say.

Bhave’s team cited senior analyst Vivek Arya, who covers the semiconductors sector, and his bullish call that despite concerns about the medium term, capital expenditures will still power GDP growth. Arya previously told Fortune in an interview that he thinks jitters have to do with this particular time of year, the fourth-quarter crunch, as most businesses start thinking about what’s around the bend. Economist Owen Lamont calls it “panic season” in markets, and Shalett herself noted the S&P 500 has recently managed to defy the “September curse” of historically poor performance, delivering a nearly 3% gain.

Arya told Fortune that BofA has seen “in prior years right around this time … people get justifiably very nervous about what is going to be the amount of spending next year.” In the start of 2025, he added, clients expected cloud capital expenditures to only grow about 20% or so, but that’s been blown out of the water with 50% to 60% growth instead. “But now it’s the worry again for next year and the year beyond that.”

Another voice is former Obama administration economist Jason Furman, on the faculty at Harvard, who calculated in late September that without data centers, those GDP figures would look a bit different. Subtracting all that capex results in a growth of just 0.1% on an annualized basis for the first half of 2025. To Donovan’s point, some other productive activities would have taken its place, Furman added: “Absent the AI boom we would probably have lower interest rates [and] electricity prices, thus some additional growth in other sectors. In very rough terms that could maybe make up about half of what we got from the AI boom.” Still, the question of AI and growth isn’t a straightforward one.