据Alphabet旗下人工智能机器人公司Intrinsic上周四晚间发布的声明,制造业巨头富士康(苹果、英伟达等企业的生产合作伙伴,总部位于中国台湾)将与Intrinsic成立合资企业,在富士康美国工厂部署机器人。

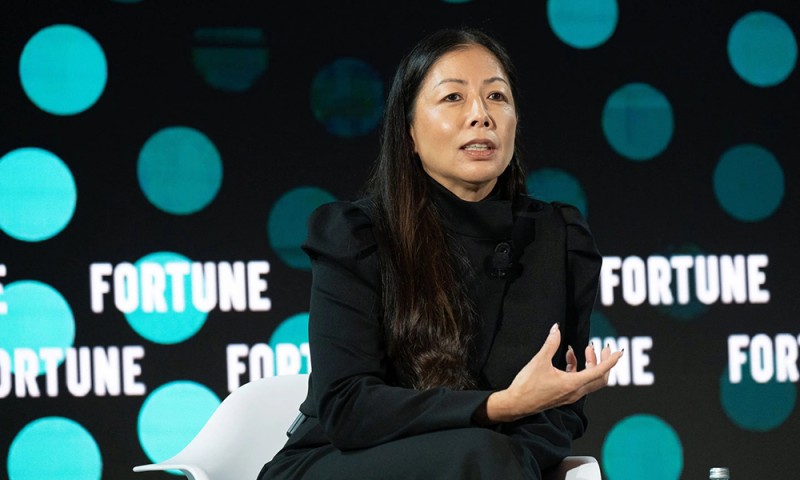

“富士康在制造领域积累了深厚的专业知识。”Intrinsic首席执行官温迪·陈·怀特在接受《财富》杂志采访时表示。她补充道,这家以组装苹果iPhone闻名的企业,深谙制造流程中哪些环节最适合借助人工智能技术进行优化升级。

Intrinsic是Alphabet“登月计划”孵化的企业,专注于突破性新技术研发。开发团队致力于降低工业机器人的使用门槛与成本,该公司已于2021年实现独立运营。

Intrinsic尤其聚焦于柔性制造领域,致力于开发能响应新数据、实现自我优化并灵活调整工作模式的自动化系统。当前,工业机器人在执行预设任务方面表现较为出色,但若要调整其工作模式,不仅难度颇高,而且成本高昂。因此,在需要灵活应对各种情况的生产场景中,人类劳动者仍是制造商的首选。

怀特透露,Intrinsic与富士康的洽谈已持续“一两年之久”,对于这家电子制造巨头而言,与Intrinsic在软件及人工智能技术方面开展合作“实属必然”。

富士康董事长刘扬伟在声明中表示:“通过与Intrinsic合作,我们能够借助其在人工智能驱动机器人领域积累的深厚专业知识。这种协同效应将进一步巩固我们在全球制造领域的领先地位,助力双方共同打造未来工厂。”

10月下旬,鸿海科技集团(富士康官方名称)宣布,将在其休斯顿新工厂部署机器人,用于生产英伟达服务器机架。此外,富士康还与英伟达合作,为台湾省医院研发医疗机器人。

富士康还与中国大陆机器人公司开展合作。今年1月,富士康高管宣布将在中国大陆工厂部署深圳优必选科技(UBTech)的机器人。

怀特未透露Intrinsic或富士康对合资企业的具体出资额,但表示该项目“并非试点项目”。

亚洲机器人

像Intrinsic新成立的合资企业这类举措,是人们日益将关注点转向“具身人工智能”(即应用于现实世界,而非纯数字软件世界的人工智能模型)这一趋势的一部分。

怀特指出,企业对机器人技术的关注部分源于新冠疫情期间的供应冲击,同时也与企业推动更多制造环节回流本土的需求有关。然而,发达经济体制造业专业人才的流失,导致工厂难以快速提升产能。

机器人技术或能从多方面解决制造业劳动力萎缩问题。怀特指出:“令人振奋的是,制造业供应链中的供应商(如机械加工厂)发现,将人工智能与机器人技术重新引入业务范畴,能吸引年轻一代回归这些行业。”

凭借技术专长与制造业规模优势,亚洲在工业机器人领域占据领先地位。其他企业正密切关注该地区的动态:英伟达首席执行官黄仁勋(Jensen Huang)盛赞韩国将成为这项新技术的未来中心。

“韩国能够生产机器人,这些机器人将进入工厂生产更多机器人,进而应用于更多工厂。”10月底,在这家美国芯片制造商宣布将向现代(Hyundai)、三星(Samsung)等韩国企业交付数万块图形处理器后,黄仁勋向记者表示。

而在这一领域占据主导地位的是中国,该国生产的工业机器人占全球总量的一半以上。如今,杭州宇树科技(Unitree)等企业正快速推进新型人形机器人研发。

“中国拥有扎实的技术与专业知识,这源于其长期积累,”怀特表示,“这一市场不容忽视。”(*)

译者:中慧言-王芳

据Alphabet旗下人工智能机器人公司Intrinsic上周四晚间发布的声明,制造业巨头富士康(苹果、英伟达等企业的生产合作伙伴,总部位于中国台湾)将与Intrinsic成立合资企业,在富士康美国工厂部署机器人。

“富士康在制造领域积累了深厚的专业知识。”Intrinsic首席执行官温迪·陈·怀特在接受《财富》杂志采访时表示。她补充道,这家以组装苹果iPhone闻名的企业,深谙制造流程中哪些环节最适合借助人工智能技术进行优化升级。

Intrinsic是Alphabet“登月计划”孵化的企业,专注于突破性新技术研发。开发团队致力于降低工业机器人的使用门槛与成本,该公司已于2021年实现独立运营。

Intrinsic尤其聚焦于柔性制造领域,致力于开发能响应新数据、实现自我优化并灵活调整工作模式的自动化系统。当前,工业机器人在执行预设任务方面表现较为出色,但若要调整其工作模式,不仅难度颇高,而且成本高昂。因此,在需要灵活应对各种情况的生产场景中,人类劳动者仍是制造商的首选。

怀特透露,Intrinsic与富士康的洽谈已持续“一两年之久”,对于这家电子制造巨头而言,与Intrinsic在软件及人工智能技术方面开展合作“实属必然”。

富士康董事长刘扬伟在声明中表示:“通过与Intrinsic合作,我们能够借助其在人工智能驱动机器人领域积累的深厚专业知识。这种协同效应将进一步巩固我们在全球制造领域的领先地位,助力双方共同打造未来工厂。”

10月下旬,鸿海科技集团(富士康官方名称)宣布,将在其休斯顿新工厂部署机器人,用于生产英伟达服务器机架。此外,富士康还与英伟达合作,为台湾省医院研发医疗机器人。

富士康还与中国大陆机器人公司开展合作。今年1月,富士康高管宣布将在中国大陆工厂部署深圳优必选科技(UBTech)的机器人。

怀特未透露Intrinsic或富士康对合资企业的具体出资额,但表示该项目“并非试点项目”。

亚洲机器人

像Intrinsic新成立的合资企业这类举措,是人们日益将关注点转向“具身人工智能”(即应用于现实世界,而非纯数字软件世界的人工智能模型)这一趋势的一部分。

怀特指出,企业对机器人技术的关注部分源于新冠疫情期间的供应冲击,同时也与企业推动更多制造环节回流本土的需求有关。然而,发达经济体制造业专业人才的流失,导致工厂难以快速提升产能。

机器人技术或能从多方面解决制造业劳动力萎缩问题。怀特指出:“令人振奋的是,制造业供应链中的供应商(如机械加工厂)发现,将人工智能与机器人技术重新引入业务范畴,能吸引年轻一代回归这些行业。”

凭借技术专长与制造业规模优势,亚洲在工业机器人领域占据领先地位。其他企业正密切关注该地区的动态:英伟达首席执行官黄仁勋(Jensen Huang)盛赞韩国将成为这项新技术的未来中心。

“韩国能够生产机器人,这些机器人将进入工厂生产更多机器人,进而应用于更多工厂。”10月底,在这家美国芯片制造商宣布将向现代(Hyundai)、三星(Samsung)等韩国企业交付数万块图形处理器后,黄仁勋向记者表示。

而在这一领域占据主导地位的是中国,该国生产的工业机器人占全球总量的一半以上。如今,杭州宇树科技(Unitree)等企业正快速推进新型人形机器人研发。

“中国拥有扎实的技术与专业知识,这源于其长期积累,”怀特表示,“这一市场不容忽视。”(*)

译者:中慧言-王芳

Foxconn, the Taiwan-based manufacturing partner of companies like Apple and Nvidia, and Intrinsic, an AI and robotics company under the Alphabet umbrella, are investing in a joint venture that will deploy robots in Foxconn’s U.S. factories, according to a statement from Intrinsic released Thursday evening.

“Foxconn just has huge manufacturing expertise,” Wendy Tan White, CEO of Intrinsic, said to Fortune in an interview. She added that Foxconn, perhaps best known for its work assembling Apple’s iPhones, will know which parts of the manufacturing process can be best improved through AI.

Intrinsic is a graduate of Alphabet’s moonshot program, focused on developing breakthrough new technologies. Developers worked on ways to make industrial robots easier and cheaper to use; Alphabet debuted the firm as a separate company in 2021.

In particular, Intrinsic focuses on flexible manufacturing, or developing automated systems that can respond to new data, self-optimize, and adapt how they work. Currently, industrial robots are best applied to predetermined tasks, and it is difficult —and expensive—to change how they work. That’s why human labor, in many situations, is still a better option for manufacturers that need flexibility.

White says that Intrinsic and Foxconn had been in conversations for “maybe a year or two now,” and that it was “inevitable” that the electronics manufacturing giant would want to cooperate with Intrinsic on software and AI development.

“In working with Intrinsic, we are able to tap their deep expertise in AI-driven robotics,” Foxconn chair Young Liu said in a statement. “This synergy complements our global manufacturing leadership, enabling us to collaboratively unlock the factory of the future.”

In late October, Foxconn, whose official name is Hon Hai Technology Group, announced that it would deploy robots at its new Houston plant producing Nvidia server racks. Foxconn is also working with Nvidia to create medical robots for Taiwan’s hospitals.

The Taiwanese company is also cooperating with robotics firms from mainland China. In January, a Foxconn executive announced that the company would deploy robots from Shenzhen-based UBTech in its factories in mainland China.

White declined to share how much money Intrinsic or Foxconn was contributing to the joint venture, but did share that the initiative was “not a pilot.”

Asian robots

Initiatives like Intrinsic’s new joint venture are part of a growing shift in attention to “physical AI,” or AI models applied in the real world as opposed to the purely digital world of software.

White suggested that some of the interest in robotics is the result of COVID-era supply shocks, and companies’ recognition that they needed to onshore more manufacturing. Yet the loss of manufacturing expertise in advanced economies has meant that factories can’t easily scale up production.

Robotics could help solve the problem of a shrinking manufacturing workforce–in more ways than one. “What’s interesting and heartening is that suppliers within manufacturing supply chains, like machine shops, are finding that bringing AI and robotics back into the conversation is bringing the young back into those industries, too,” White suggested.

Asia, owing to its combination of technical expertise and manufacturing footprint, is taking the lead in industrial robotics. Other companies are paying attention to this region; Nvidia CEO Jensen Huang has touted South Korea as a future hub for this new technology.

“Korea can create the robots, which then work in factories to create more robots, which work in more factories,” Huang told reporters in late October, right after the U.S. chipmaker announced that it would ship tens of thousands of GPUs to Korean companies like Hyundai and Samsung.

Yet the biggest player in this space is China, which makes more than half of the world’s industrial robots. Firms like Hangzhou-based Unitree are now rapidly developing new humanoid robots.

“They’ve got the skills and expertise, because they’ve been producing for so long,” White said. “I wouldn’t ignore it.”