投资研究机构艾摩宏观(Alpine Macro)首席全球策略师Chen Zhao表示,近期企业利润大幅增长,而劳动力市场持续低迷,造成这种强烈反差的原因可能是AI的应用。

Chen Zhao在周一发布的报告《就业低迷下的利润繁荣》(A Jobless Profit Boom)中指出,这种反差在科技行业表现得尤为明显:该行业利润一路飙升,而就业却已陷入长达三年的“衰退”。

他在报告中表示:“我们认为,科技行业的裁员主要是由AI取代人类劳动力所致。”他举例提到了亚马逊(Amazon)、Meta以及赛富时(Salesforce)近期的裁员行动。“然而,这些公司的裁员均发生在利润大幅增长的时期,这与以往通常在利润下滑后进行裁员的现象截然不同。”

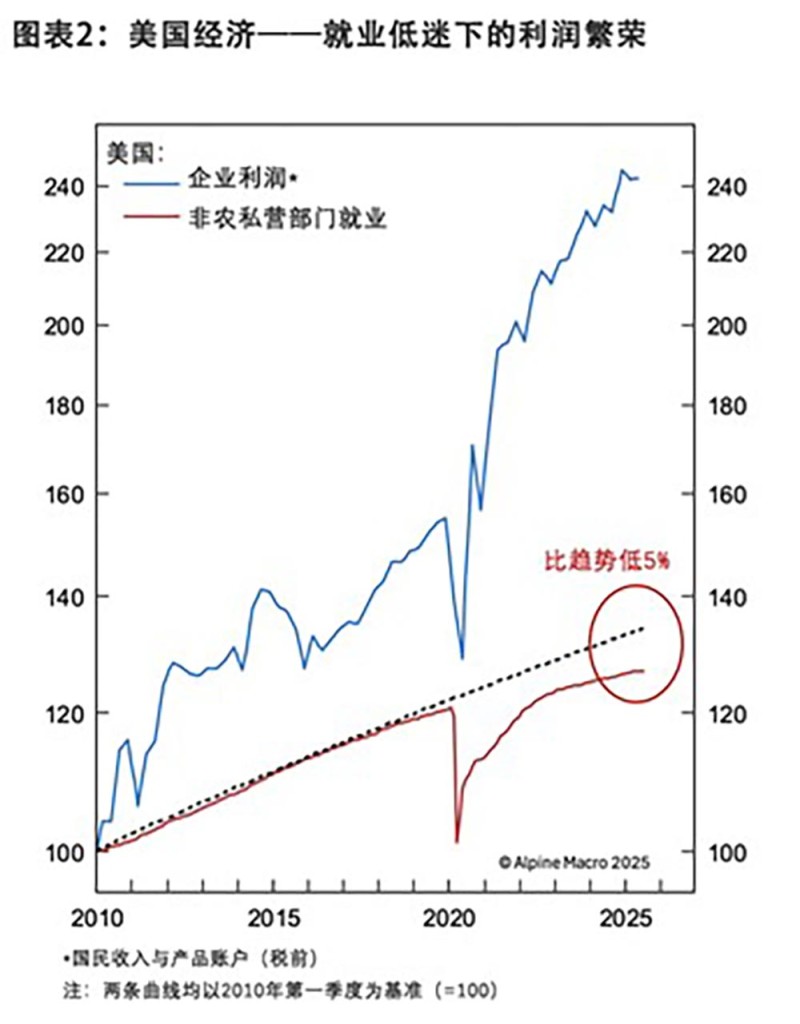

Chen Zhao指出,这种就业低迷而利润大幅增长的现象已不再局限于科技行业,而是迅速蔓延为整个美国经济层面的趋势。

事实上,尽管美国私营部门的总就业人数已从新冠疫情早期的低谷中回升,但当前水平仍较疫情前的趋势低5%。

Chen Zhao写道:“换句话说,自疫情危机以来,尽管企业利润已飙升至历史新高,但就业岗位出现了永久性流失。”

与此同时,近年来美国生产率显著提升,目前的增速已超过过去十年的两倍。

Chen Zhao认为,AI是这种趋势背后的原因,且该技术正加速取代人工。然而,虽然劳动力需求下降,人口老龄化以及总统唐纳德·特朗普推动的移民收紧政策,也同时削弱了劳动力供给。

这些趋势共同作用,形成了一种新的均衡格局:即便招聘放缓,失业率仍维持在较低水平。

Chen Zhao解释称:“在正常情况下,劳动力增长放缓会拖累经济增长。但在生产率提升的推动下,美国经济即便在用工减少的情况下,仍能实现更高的产出和利润。”

艾摩宏观[隶属于牛津经济研究院(Oxford Economics)]的这份分析报告,也印证了计算机科学家、诺贝尔奖得主杰弗里·辛顿的观点:AI会影响就业市场,而引领潮流的企业在其中扮演着关键角色。

辛顿在上周五接受彭博电视节目《华尔街周》(Wall Street Week)采访时表示,除了通过向用户收取聊天机器人使用费外,企业从AI投资中获利的最直接方式,就是用更低成本的替代品取代人工。

被誉为“AI教父”的辛顿补充说,尽管有经济学家认为,以往的颠覆性技术在摧毁旧岗位的同时,也创造了新岗位,但他并不确定AI是否会重演这一模式。

辛顿警告称:“我认为,大企业都在押注AI将大规模取代人类的工作岗位,因为企业能从中获取巨额利润。”

这番言论与他9月接受《金融时报》采访时的观点一致。当时他直言,AI将“造成大规模失业,同时带来利润暴涨”,并将这一现象归因于资本主义制度本身。(*)

译者:刘进龙

审校:汪皓

投资研究机构艾摩宏观(Alpine Macro)首席全球策略师Chen Zhao表示,近期企业利润大幅增长,而劳动力市场持续低迷,造成这种强烈反差的原因可能是AI的应用。

Chen Zhao在周一发布的报告《就业低迷下的利润繁荣》(A Jobless Profit Boom)中指出,这种反差在科技行业表现得尤为明显:该行业利润一路飙升,而就业却已陷入长达三年的“衰退”。

他在报告中表示:“我们认为,科技行业的裁员主要是由AI取代人类劳动力所致。”他举例提到了亚马逊(Amazon)、Meta以及赛富时(Salesforce)近期的裁员行动。“然而,这些公司的裁员均发生在利润大幅增长的时期,这与以往通常在利润下滑后进行裁员的现象截然不同。”

Chen Zhao指出,这种就业低迷而利润大幅增长的现象已不再局限于科技行业,而是迅速蔓延为整个美国经济层面的趋势。

事实上,尽管美国私营部门的总就业人数已从新冠疫情早期的低谷中回升,但当前水平仍较疫情前的趋势低5%。

Chen Zhao写道:“换句话说,自疫情危机以来,尽管企业利润已飙升至历史新高,但就业岗位出现了永久性流失。”

与此同时,近年来美国生产率显著提升,目前的增速已超过过去十年的两倍。

Chen Zhao认为,AI是这种趋势背后的原因,且该技术正加速取代人工。然而,虽然劳动力需求下降,人口老龄化以及总统唐纳德·特朗普推动的移民收紧政策,也同时削弱了劳动力供给。

这些趋势共同作用,形成了一种新的均衡格局:即便招聘放缓,失业率仍维持在较低水平。

Chen Zhao解释称:“在正常情况下,劳动力增长放缓会拖累经济增长。但在生产率提升的推动下,美国经济即便在用工减少的情况下,仍能实现更高的产出和利润。”

艾摩宏观[隶属于牛津经济研究院(Oxford Economics)]的这份分析报告,也印证了计算机科学家、诺贝尔奖得主杰弗里·辛顿的观点:AI会影响就业市场,而引领潮流的企业在其中扮演着关键角色。

辛顿在上周五接受彭博电视节目《华尔街周》(Wall Street Week)采访时表示,除了通过向用户收取聊天机器人使用费外,企业从AI投资中获利的最直接方式,就是用更低成本的替代品取代人工。

被誉为“AI教父”的辛顿补充说,尽管有经济学家认为,以往的颠覆性技术在摧毁旧岗位的同时,也创造了新岗位,但他并不确定AI是否会重演这一模式。

辛顿警告称:“我认为,大企业都在押注AI将大规模取代人类的工作岗位,因为企业能从中获取巨额利润。”

这番言论与他9月接受《金融时报》采访时的观点一致。当时他直言,AI将“造成大规模失业,同时带来利润暴涨”,并将这一现象归因于资本主义制度本身。(*)

译者:刘进龙

审校:汪皓

Booming corporate earnings and a slumping labor market have been telling very different stories lately, and AI is the likely explanation, according to Chen Zhao, chief global strategist at Alpine Macro.

That dichotomy is exemplified in the tech sector, which has seen profits soar while employment has been in a “recession” for three years, he said in a Monday note titled “A Jobless Profit Boom.”

“We suspect that job losses in tech have been driven mainly by AI displacement,” Zhao added, pointing to recent cuts at Amazon, Meta and Salesforce. “These layoffs, however, are happening amid exceptionally strong profit growth in these companies—a significant departure from the past, when job cuts typically followed declining profitability.”

This jobless profit boom isn’t limited to the tech sector and has quickly become an economy-wide phenomenon, he said.

In fact, while overall private-sector payrolls have rebounded from the early days of COVID, it is still 5% below where the pre-pandemic trend would have been by this time.

“In other words, there has been a permanent loss of jobs since the pandemic crisis, even as corporate profits have surged to record highs,” Zhao said.

At the same time, productivity has been surging in recent years, and it is currently growing more than twice as fast as it did in the previous decade.

Zhao thinks AI is the reason and noted the technology is displacing labor at an accelerating pace. But while labor demand is down, aging demographics and President Donald Trump’s immigration crackdown have weakened labor supply as well.

Those trends have created a new equilibrium that are keeping a lid on unemployment even as hiring stays subdued.

“Under normal circumstances, slower labor force growth should weigh on economic growth,” Zhao explained. “However, rising productivity has allowed the U.S. economy to produce more output—and higher profits—with fewer workers.”

The analysis from Alpine Macro, which is part of Oxford Economics, reinforces what computer scientist and Nobel laureate Geoffrey Hinton has been saying about AI’s impact on the labor market and the role of companies leading the charge.

In an interview with Bloomberg TV’s Wall Street Week on Friday, he said the obvious way to make money off AI investments, aside from charging fees to use chatbots, is to replace workers with something cheaper.

Hinton, whose work has earned him a Nobel Prize and the moniker “godfather of AI,” added that while some economists point out previous disruptive technologies created as well as destroyed jobs, it’s not clear to him that AI will do the same.

“I think the big companies are betting on it causing massive job replacement by AI, because that’s where the big money is going to be,” he warned.

The remarks echo what he said in September, when he told the Financial Times that AI will “create massive unemployment and a huge rise in profits,” attributing it to the capitalist system.