招聘网站Glassdoor在11月中旬曾警告“永久裁员潮”出现。今年持续的小规模裁员尽管未引起大多数媒体头条的关注,却在白领阶层中引发了普遍焦虑。如今,招聘咨询公司Challenger, Gray & Christmas补充了一个关键观点和重磅数字:今年至今已宣布裁员110万人,这是自1993年以来第六次突破这一水平。除了2020年疫情这个可以理解的特殊例外,上一次更大规模裁员还要追溯至2009年,当时正值“大衰退”的谷底时期。

科技业仍是受冲击最严重的私营行业,今年以来已宣布裁员超过15万人。在经历前几年的高速扩张后,企业纷纷调整人力结构,并日益依赖自动化。此外,电信运营商、食品公司、服务企业、零售商、非营利组织以及媒体机构同样出现裁员,许多行业的裁员规模同比增幅达到两位数甚至三位数。

具体来看,美国雇主在2025年前11个月共宣布裁员1,170,821人,较2024年同期增加 54%。这使得2025年成为自1993年以来,截至11月裁员人数便超过110万的六个年份之一,与2001年、2002年、2003年、2009年以及疫情冲击的2020年并列。仅11月份便裁员71,321人,为自2022年以来同期最高,且远高于疫情前的同月典型水平。

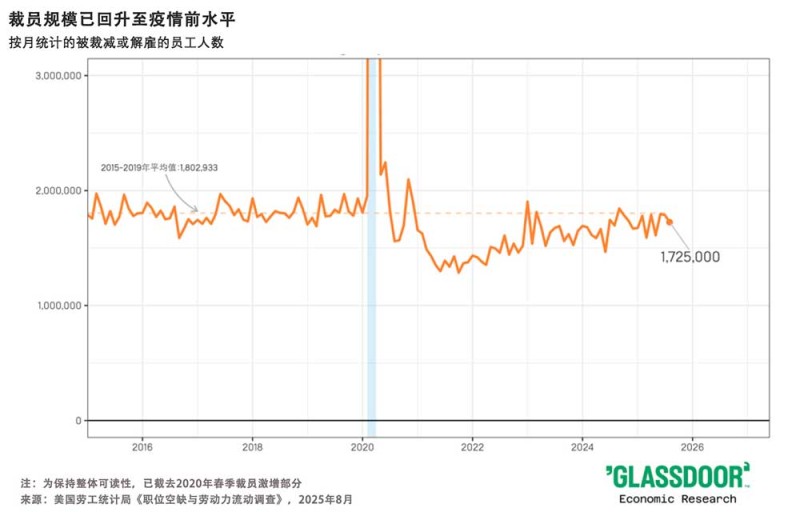

Glassdoor首席经济学家丹尼尔·赵在接受《财富》杂志采访时指出,这实际上低估了真实裁员规模。职位空缺与劳动力流动调查(JOLTS)的联邦数据显示,同期约有170万人被裁。他表示:“我们在研究中发现了一个有趣的现象,那就是裁员的形态正在发生变化。与以往的大规模一次性裁员不同,我们现在看到的是‘滚动式裁员’甚至更小规模的裁员。”

“滚动式裁员”现象必须结合2025年诸多相互矛盾的经济信号来考虑。今年,“可负担性”政治议题的兴起,反映出弱势工人群体的普遍不满。对人工智能泡沫的担忧,与就业焦虑、Z世代对高失业率和入门级岗位短缺的焦虑同时存在。

按照许多高管的说法,越来越多的企业财报揭示出所谓的“分化型”或“K型”经济结构,反映出富裕阶层与贫困阶层之间的发展差异。富裕阶层消费自由,最富裕的10%人群几乎贡献了近50%的消费支出,并承受了因关税转嫁的额外成本;而低收入消费者则愈发捉襟见肘。摩根士丹利(Morgan Stanley)分析师迈克·威尔逊认为,2025年,“滚动式衰退”已席卷各经济领域;而从4月起,又开启了“滚动式复苏”。

高盛(Goldman Sachs)与美国银行研究(Bank of America Research)部门的分析师都指出,当前的复苏主要体现在金融层面:股价上涨、利润飙升,但白领岗位的需求却进一步减少。随着“永久裁员潮”愈演愈烈,一个“无就业增长”的时代以及流程优于人力的趋势,正逐渐显现。

“永久裁员”模式的内部机制

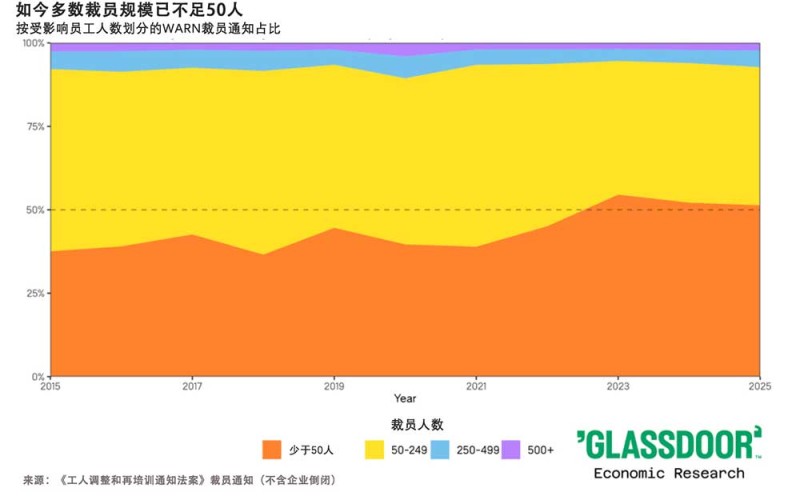

根据Glassdoor发布的《2026年职场趋势》分析,企业正从过去那种罕见的大规模裁员,转向更频繁的小规模裁员,每次影响人数不超过50人。这类“永久裁员”在部分数据中已占多数,其占比从2010年代中期的不到一半,上升至2025年的超过一半。这种新模式使企业管理层能够根据市场变化与AI应用情况,持续调整人力规模,而无需承担一次性大规模裁员对声誉与员工士气的冲击。

咨询机构指出,滚动式裁员为管理层提供了最大的灵活性,并可降低遣散与重组成本,同时通过逐步重新分配工作维持业务运转,而不必一夜之间解散整个团队。但Glassdoor警告称,这种看似高效的做法,往往会在企业内部形成一种“慢性失血”的文化:同事悄无声息地离开,留任者工作量慢慢增加,岗位安全感缺失。

丹尼尔·赵表示,这种模式让员工始终处于“忐忑不安的状态,他们持续担忧工作保障,难以真正专注于工作本身”。尽管“永久裁员”往往悄然进行,不会引发太多负面新闻,但“内部员工心知肚明,他们会意识到公司正在发生的事情”。他强调,这最终会对企业文化、员工士气以及生产率造成严重负面影响。

赵指出,Glassdoor数据中反映的“职位拒绝率”已连续两年下降。“求职者意识到自己缺乏谈判筹码,无法争取更多录用条件,或者对找到更好工作机会的能力缺乏信心。”最终的结果是,更多人选择“将就”接受任何工作,而非理想岗位。

Glassdoor的评论数据显示,员工在公司评价中提及“裁员”和“工作不安全感”的频率,现已高于2020年3月疫情爆发导致全球经济停摆时的水平。这表明,2025年底的员工对失业的焦虑感,甚至超过了百年一遇的公共卫生危机爆发之初。同时,员工对高层领导的信任度持续下滑,自2024年以来对管理层的负面描述(如“脱节”、“虚伪”等)急剧增加。

招聘计划并未抵消裁员带来的冲击。根据Challenger的报告,截至11月,企业宣布的计划招聘人数为497,151人,同比下降35%,为2010年以来同期最低。在招聘需求跌至十年低点、连续裁员常态化的背景下,为了在愈发严苛的市场中重新站稳脚跟,许多求职者不得不接受过去可能会直接拒绝的职位。

丹尼尔·赵对“就业衰退”的说法持保留意见,但他也承认,过去两年间,招聘“极其低迷”,且已有迹象显示就业增长显著放缓甚至进入负区间,部分月份还出现了岗位净减少。

他表示:“我认为在正式宣布进入就业衰退之前,还需要看到更多证据。个别月份出现就业负增长确实不是好事,但我们不应该仅凭一两个月的数据就断言趋势发生了根本性转变。”

AI、重组与新权力平衡

在这轮裁员潮背后,多重力量正重新塑造企业的用人决策。Challenger的报告显示,业务重组、部门关闭以及市场或经济环境,是2025年裁员的主要驱动因素,另有数万岗位明确与AI应用相关。自2023年以来,雇主将超过7万个宣布裁撤的岗位归因于人工智能,因为他们正通过日常工作自动化削减人力,并围绕新工具重组团队架构。

Glassdoor的分析师指出,过去几年员工可以要求灵活性、更高薪酬和更快晋升,而当前的环境使议价权重新回到了雇主手中。远程办公和混合办公人员的“职业发展机会评分”下滑,因为晋升机会越来越偏向于办公室员工,迫使许多人在“灵活性”与“安全感”之间做出取舍。

再加上“永久裁员”带来的阴影,这种取舍正将职场环境从疫情时期的员工赋权,演变为一种长期的不安全感,以及“以更少资源完成更多任务”的硬性要求——而这一趋势在2026年丝毫没有任何缓解迹象。

压力不仅体现在企业重组计划中,也反映在实时工资数据上。ADP周三发布的11月份就业报告显示,私营部门当月裁员3.2万人,几乎全部来自小企业,它们共裁撤了12万个岗位,而大企业实际新增了9万个岗位。

ADP首席经济学家内拉·理查森在报告中称,就业下降趋势具有“普遍性”,但强调现金流有限、利润率偏低的小企业“正在经受不确定宏观环境和谨慎消费的考验”。关税、公用事业账单与美联储迟迟不愿降息,使小企业的运营成本持续上升;相比之下,大型企业则更有能力承受这些压力。

这种分化进一步凸显劳动力市场日益扩大的“K型结构”。大企业通过悄无声息地滚动式裁员削减白领与企业岗位,而小企业在关税、公用事业账单上涨与消费者需求疲软的多重压力下,出现实质性收缩。理查森对Axios表示,在经济下行期,小企业几乎总是最先裁员,因为它们能更早感受到消费支出放缓的冲击,也最缺乏吸收成本上升的空间。大型企业尽管也在默默重组团队,但他们拥有现金流、规模优势与融资渠道,可以等待不确定性消退;而小企业则会直接耗尽利润空间。

不过,特朗普政府商务部长霍华德·鲁特尼克在接受CNBC采访时,将ADP的数据归咎于“民主党导致政府停摆”,而非关税。他声称这些数据未来将“重新平衡并再次增长”,并表示“这只是一个短期现象”。

丹尼尔·赵认为,“永久裁员”正在加剧员工对2025年经济状况的“不安感”。“员工对工作保障怀有强烈的不确定性和焦虑感,担心一两个月后又会发生新一轮裁员。”他补充说,这意味着“员工始终处于如履薄冰的紧张状态”。(*)

译者:刘进龙

审校:汪皓

招聘网站Glassdoor在11月中旬曾警告“永久裁员潮”出现。今年持续的小规模裁员尽管未引起大多数媒体头条的关注,却在白领阶层中引发了普遍焦虑。如今,招聘咨询公司Challenger, Gray & Christmas补充了一个关键观点和重磅数字:今年至今已宣布裁员110万人,这是自1993年以来第六次突破这一水平。除了2020年疫情这个可以理解的特殊例外,上一次更大规模裁员还要追溯至2009年,当时正值“大衰退”的谷底时期。

科技业仍是受冲击最严重的私营行业,今年以来已宣布裁员超过15万人。在经历前几年的高速扩张后,企业纷纷调整人力结构,并日益依赖自动化。此外,电信运营商、食品公司、服务企业、零售商、非营利组织以及媒体机构同样出现裁员,许多行业的裁员规模同比增幅达到两位数甚至三位数。

具体来看,美国雇主在2025年前11个月共宣布裁员1,170,821人,较2024年同期增加 54%。这使得2025年成为自1993年以来,截至11月裁员人数便超过110万的六个年份之一,与2001年、2002年、2003年、2009年以及疫情冲击的2020年并列。仅11月份便裁员71,321人,为自2022年以来同期最高,且远高于疫情前的同月典型水平。

Glassdoor首席经济学家丹尼尔·赵在接受《财富》杂志采访时指出,这实际上低估了真实裁员规模。职位空缺与劳动力流动调查(JOLTS)的联邦数据显示,同期约有170万人被裁。他表示:“我们在研究中发现了一个有趣的现象,那就是裁员的形态正在发生变化。与以往的大规模一次性裁员不同,我们现在看到的是‘滚动式裁员’甚至更小规模的裁员。”

“滚动式裁员”现象必须结合2025年诸多相互矛盾的经济信号来考虑。今年,“可负担性”政治议题的兴起,反映出弱势工人群体的普遍不满。对人工智能泡沫的担忧,与就业焦虑、Z世代对高失业率和入门级岗位短缺的焦虑同时存在。

按照许多高管的说法,越来越多的企业财报揭示出所谓的“分化型”或“K型”经济结构,反映出富裕阶层与贫困阶层之间的发展差异。富裕阶层消费自由,最富裕的10%人群几乎贡献了近50%的消费支出,并承受了因关税转嫁的额外成本;而低收入消费者则愈发捉襟见肘。摩根士丹利(Morgan Stanley)分析师迈克·威尔逊认为,2025年,“滚动式衰退”已席卷各经济领域;而从4月起,又开启了“滚动式复苏”。

高盛(Goldman Sachs)与美国银行研究(Bank of America Research)部门的分析师都指出,当前的复苏主要体现在金融层面:股价上涨、利润飙升,但白领岗位的需求却进一步减少。随着“永久裁员潮”愈演愈烈,一个“无就业增长”的时代以及流程优于人力的趋势,正逐渐显现。

“永久裁员”模式的内部机制

根据Glassdoor发布的《2026年职场趋势》分析,企业正从过去那种罕见的大规模裁员,转向更频繁的小规模裁员,每次影响人数不超过50人。这类“永久裁员”在部分数据中已占多数,其占比从2010年代中期的不到一半,上升至2025年的超过一半。这种新模式使企业管理层能够根据市场变化与AI应用情况,持续调整人力规模,而无需承担一次性大规模裁员对声誉与员工士气的冲击。

咨询机构指出,滚动式裁员为管理层提供了最大的灵活性,并可降低遣散与重组成本,同时通过逐步重新分配工作维持业务运转,而不必一夜之间解散整个团队。但Glassdoor警告称,这种看似高效的做法,往往会在企业内部形成一种“慢性失血”的文化:同事悄无声息地离开,留任者工作量慢慢增加,岗位安全感缺失。

丹尼尔·赵表示,这种模式让员工始终处于“忐忑不安的状态,他们持续担忧工作保障,难以真正专注于工作本身”。尽管“永久裁员”往往悄然进行,不会引发太多负面新闻,但“内部员工心知肚明,他们会意识到公司正在发生的事情”。他强调,这最终会对企业文化、员工士气以及生产率造成严重负面影响。

赵指出,Glassdoor数据中反映的“职位拒绝率”已连续两年下降。“求职者意识到自己缺乏谈判筹码,无法争取更多录用条件,或者对找到更好工作机会的能力缺乏信心。”最终的结果是,更多人选择“将就”接受任何工作,而非理想岗位。

Glassdoor的评论数据显示,员工在公司评价中提及“裁员”和“工作不安全感”的频率,现已高于2020年3月疫情爆发导致全球经济停摆时的水平。这表明,2025年底的员工对失业的焦虑感,甚至超过了百年一遇的公共卫生危机爆发之初。同时,员工对高层领导的信任度持续下滑,自2024年以来对管理层的负面描述(如“脱节”、“虚伪”等)急剧增加。

招聘计划并未抵消裁员带来的冲击。根据Challenger的报告,截至11月,企业宣布的计划招聘人数为497,151人,同比下降35%,为2010年以来同期最低。在招聘需求跌至十年低点、连续裁员常态化的背景下,为了在愈发严苛的市场中重新站稳脚跟,许多求职者不得不接受过去可能会直接拒绝的职位。

丹尼尔·赵对“就业衰退”的说法持保留意见,但他也承认,过去两年间,招聘“极其低迷”,且已有迹象显示就业增长显著放缓甚至进入负区间,部分月份还出现了岗位净减少。

他表示:“我认为在正式宣布进入就业衰退之前,还需要看到更多证据。个别月份出现就业负增长确实不是好事,但我们不应该仅凭一两个月的数据就断言趋势发生了根本性转变。”

AI、重组与新权力平衡

在这轮裁员潮背后,多重力量正重新塑造企业的用人决策。Challenger的报告显示,业务重组、部门关闭以及市场或经济环境,是2025年裁员的主要驱动因素,另有数万岗位明确与AI应用相关。自2023年以来,雇主将超过7万个宣布裁撤的岗位归因于人工智能,因为他们正通过日常工作自动化削减人力,并围绕新工具重组团队架构。

Glassdoor的分析师指出,过去几年员工可以要求灵活性、更高薪酬和更快晋升,而当前的环境使议价权重新回到了雇主手中。远程办公和混合办公人员的“职业发展机会评分”下滑,因为晋升机会越来越偏向于办公室员工,迫使许多人在“灵活性”与“安全感”之间做出取舍。

再加上“永久裁员”带来的阴影,这种取舍正将职场环境从疫情时期的员工赋权,演变为一种长期的不安全感,以及“以更少资源完成更多任务”的硬性要求——而这一趋势在2026年丝毫没有任何缓解迹象。

压力不仅体现在企业重组计划中,也反映在实时工资数据上。ADP周三发布的11月份就业报告显示,私营部门当月裁员3.2万人,几乎全部来自小企业,它们共裁撤了12万个岗位,而大企业实际新增了9万个岗位。

ADP首席经济学家内拉·理查森在报告中称,就业下降趋势具有“普遍性”,但强调现金流有限、利润率偏低的小企业“正在经受不确定宏观环境和谨慎消费的考验”。关税、公用事业账单与美联储迟迟不愿降息,使小企业的运营成本持续上升;相比之下,大型企业则更有能力承受这些压力。

这种分化进一步凸显劳动力市场日益扩大的“K型结构”。大企业通过悄无声息地滚动式裁员削减白领与企业岗位,而小企业在关税、公用事业账单上涨与消费者需求疲软的多重压力下,出现实质性收缩。理查森对Axios表示,在经济下行期,小企业几乎总是最先裁员,因为它们能更早感受到消费支出放缓的冲击,也最缺乏吸收成本上升的空间。大型企业尽管也在默默重组团队,但他们拥有现金流、规模优势与融资渠道,可以等待不确定性消退;而小企业则会直接耗尽利润空间。

不过,特朗普政府商务部长霍华德·鲁特尼克在接受CNBC采访时,将ADP的数据归咎于“民主党导致政府停摆”,而非关税。他声称这些数据未来将“重新平衡并再次增长”,并表示“这只是一个短期现象”。

丹尼尔·赵认为,“永久裁员”正在加剧员工对2025年经济状况的“不安感”。“员工对工作保障怀有强烈的不确定性和焦虑感,担心一两个月后又会发生新一轮裁员。”他补充说,这意味着“员工始终处于如履薄冰的紧张状态”。(*)

译者:刘进龙

审校:汪皓

Jobs website Glassdoor warned of “forever layoffs” in mid-November, as a small drip-drip-drip of cuts throughout the year flew under the radar of most newspaper headlines while instilling fear throughout white-collar ranks. Now the recruitment firm Challenger, Gray & Christmas has added a crucial bit of insight and one big number: 1.1 million. That’s how many layoffs have been announced year to date, only the sixth time since 1993 that threshold has been breached. With the notable and understandable exception of the pandemic year of 2020, you have to go back to 2009 to find a year with greater layoffs, and that was in the very depths of the Great Recession.

Technology remains the hardest-hit private sector industry, with more than 150,000 job cuts announced so far this year as firms continue to reset headcount after the boom years while they increasingly lean into automation. Telecom providers, food companies, services firms, retailers, nonprofits, and media organizations are all shedding workers as well, in many cases at double- or triple-digit percentage increases over last year.

Specifically, U.S.-based employers announced 1,170,821 job cuts in the first 11 months of 2025, up 54% from the same period in 2024. That makes 2025 one of only six years since 1993 in which announced layoffs through November have topped 1.1 million, putting it in the company of 2001, 2002, 2003, 2009, and the pandemic shock of 2020. November alone saw 71,321 cuts, the highest for that month since 2022 and well above typical pre-pandemic November levels.

Daniel Zhao, chief economist for Glassdoor, noted in an interview with Fortune that this actually understates the typical, true number of layoffs, citing federal data from the JOLTS survey that roughly 1.7 million people had been laid off over the same period. “The interesting thing that we saw in our research is that the shape of these layoffs is changing,” he said. “So instead of these large one-off layoffs, we’re seeing rolling layoffs and even some smaller layoffs as well.”

The “rolling layoff” must be considered amid the many conflicting signals of the economy of 2025, when “affordability” politics emerged to reflect mass unrest among vulnerable workers. Fears of a bubble in artificial intelligence have coincided with worker anxiety and Gen Z despair over an elevated unemployment rate and a dearth of entry-level positions.

Earnings reports increasingly reveal, as many executives call it, a “bifurcated” or “K-shaped” economy, used to describe the different trajectories of rich and poor. The wealthier cohort is spending freely, with the upper 10% accounting for nearly 50% of consumer spending (and absorbing elevated costs passed through from tariffs), while the lower-income consumer shows increasing signs of strain. Morgan Stanley analyst Mike Wilson believes a “rolling recession” was tearing through different sectors of the economy and that, from April onward, a “rolling recovery” has been underway in 2025.

Analysts at both Goldman Sachs and Bank of America Research have noted that this recovery is a financial one, reflected in stock prices and soaring profits—and increasingly in fewer workers required in white-collar positions. The era of “jobless growth” and process over people is emerging into view, thanks to the forever layoff.

Inside the ‘forever layoff’ model

Glassdoor’s 2026 Worklife Trends analysis describes a structural shift away from rare, large-scale reductions toward frequent layoffs affecting fewer than 50 workers at a time. These “forever layoffs” now account for a majority of cuts in some data, with the share of small layoffs rising from well under half in the mid-2010s to more than half by 2025. The new model allows leaders to continuously adjust headcount in response to markets and AI adoption without the reputational and morale shock of a single blockbuster layoff event.

Consultants say rolling layoffs give executives maximum flexibility and can lower severance and restructuring costs, while keeping operations running by redistributing work slowly instead of wiping out entire teams overnight. But what looks efficient on paper, Glassdoor warns, creates a slow-bleed culture in which coworkers quietly disappear, workloads creep up for survivors, and no one ever feels truly safe in their role.

Zhao described it as “keeping workers in suspense, where they’re constantly worried about their job security and they can’t focus on their work.” Even though these forever layoffs might sneak under the radar and not generate quite as many downbeat headlines, “people internally know what’s up; they’re going to recognize what’s happening.” Ultimately, he said he believes it has a really negative impact on culture and morale and hence productivity.

Zhao cited the job-rejection rate that appears in Glassdoor data, which has been declining for two years. “I think what’s going on there is job seekers recognize that they don’t have the leverage to negotiate, as much leverage to negotiate on an offer, or they don’t feel confident in their ability to find a better offer elsewhere.” The end result is more people “settling” for just any job, not the right job.

Glassdoor’s review data shows employee mentions of “layoffs” and “job insecurity” in company ratings are now higher than they were in March 2020, when the pandemic first shut down the global economy. That suggests workers in late 2025 feel more anxious about losing their jobs than they did at the onset of a once-in-a-century public health crisis. Trust in senior leadership has eroded as well, with negative descriptions of executives—such as “misaligned” or “hypocritical”—rising sharply since 2024.

Hiring plans are not offsetting the damage. Through November, per the Challenger report, employers have announced 497,151 planned hires, down 35% from the same point last year and the lowest year-to-date total since 2010. With hiring at a decade low and serial layoffs becoming normalized, many job seekers are taking roles they would once have rejected simply to regain a foothold in a less forgiving market.

Zhao pushed back on the idea of a “jobs recession,” although he acknowledged that hiring has been “very sluggish” for much of the past two years and there is some evidence of job growth slowing significantly and reaching negative territory, including some months with job losses.

“I think you would want to see more evidence before declaring an actual jobs recession,” he said. “A month here and there of negative jobs growth is not good, but we don’t want to declare a new trend based on just a month or two’s worth of data.”

AI, restructurings, and the new power balance

Behind the cuts, a cluster of forces is reshaping corporate staffing decisions. Challenger’s report shows restructuring, business unit closures, and market or economic conditions have driven the bulk of 2025 layoffs, with tens of thousands of jobs also explicitly tied to AI adoption. Since 2023, employers have blamed artificial intelligence for more than 70,000 announced job cuts as they automate routine work and reorganize teams around new tools.

Glassdoor’s analysts say this environment has shifted bargaining power back to employers after several years when workers could demand flexibility, higher pay, and faster advancement. Remote and hybrid staff now report declining career opportunity ratings as promotions increasingly favor in-office employees, forcing many to trade flexibility for perceived security.

Combined with the drumbeat of forever layoffs, those tradeoffs are ushering in a workplace defined less by pandemic-era empowerment than by chronic insecurity and a “do more with less” mandate that shows no sign of easing in 2026.

The squeeze is showing up not just in corporate restructuring plans, but also in real-time payroll data. ADP’s November report, released Wednesday, found private employers shed 32,000 jobs last month—but nearly all of the losses came from small businesses, which cut 120,000 positions, while large corporations actually added 90,000 workers.

ADP chief economist Nela Richardson, in the report, called the decline “broad-based,” but emphasized that small firms with limited cash flow and thin margins “are really weathering an uncertain macro environment and a cautious consumer.” Small employers have faced rising operating costs from tariffs, utility bills, and a Fed hesitant to cut rates, a burden that larger companies have been far better positioned to absorb.

The divergence underscores the widening K-shape in the labor market. White-collar and corporate jobs are being trimmed through rolling, under-the-radar layoffs, while small businesses are facing outright contraction as they struggle with tariffs, higher utility bills, and softer consumer demand. Small firms are almost always the first to lay off workers in a downturn because they feel the pullback in spending sooner and have far less room to absorb rising input costs, Richardson told Axios. Larger companies have the cash flow, scale, and financing to wait out uncertainty, even as they quietly restructure teams, but small employers simply run out of margin.

However, Howard Lutnick, Trump’s commerce secretary, blamed the data on the “Democrat shutdown,” rather than tariffs, during an interview on CNBC. The cabinet secretary also said those figures will “rebalance and they’ll regrow,” claiming “this is just a near-term event.”

Zhao said he thinks the forever layoffs are contributing to the “malaise” that workers feel about the economy of 2025. “There’s a significant amount of uncertainty and anxiety that workers are feeling around job security and the risk that another layoff might be coming in just a month or two.” It means, he added, that “workers are constantly on edge.”